ADCs & Bispecifics Lead Oncologist Excitement for Emerging Cancer Therapies

Healthcare Provider Sentiment Toward Emerging Cancer Therapeutics

As the oncology community prepares for American Society of Clinical Oncology's annual meeting in 2025, new research from ZoomRx reveals which therapeutic approaches and pipeline assets are commanding physician attention. This analysis provides critical insights for pharmaceutical marketers and market researchers navigating the competitive oncology landscape.

Research Methodology: Capturing Healthcare Provider Perspectives

Between February and March 2025, ZoomRx surveyed 101 oncologists across the United States, United Kingdom, and Germany. All participants had substantial knowledge of pipeline cancer treatments and averaged 14 years in clinical practice.

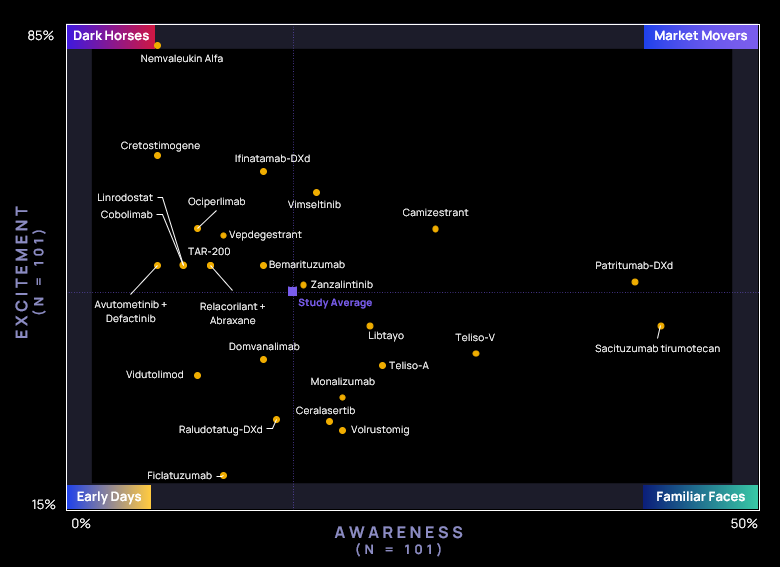

The study tracked perceptions of over 30 promising solid tumor pipeline assets expected to launch between mid-2025 and mid-2027, combining awareness and excitement metrics to generate comprehensive perception scores. The research provided an understanding of how providers view emerging therapies, also explored oncologist excitement for different mechanisms of action and unmet treatment needs across cancer types.

ADCs and Bispecifics Drive Oncologist Enthusiasm

When asked about the most exciting mechanisms being explored in oncology, bispecific antibodies and antibody-drug conjugates lead the way. Bispecifics generate excitement among 70% of surveyed oncologists, while ACDs capture interest from 63% of respondents.

The appeal of these mechanisms stems from their sophisticated approach to cancer targeting: bispecifics provide dual targeting capabilities engaging both cancer cells and immune effectors, while ADCs deliver cytotoxic payloads directly to malignant tissue. Healthcare providers consistently cite novel mechanisms of action and unique targeting approaches as primary drivers of their excitement for their top-rated pipeline assets.

Personalized mRNA therapies also show promise, with 57% expressing strong enthusiasm. This enthusiasm reflects growing confidence in precision medicine approaches and the potential for truly individualized cancer treatment strategies

Addressing Critical Treatment Gaps: Tolerability and Hard-to-Treat Cancers

The research reveals healthcare providers' primary unmet need focuses on treatment tolerability and therapeutic options for challenging cancer types. When asked about the biggest unmet needs to be addressed by future treatments, improved tolerability emerges as the top unmet need for 57% of physicians, followed closely by enhanced targeting (49%) and reduced adverse events (38%).

When asked about the tumor types with the biggest treatment needs, healthcare providers identified specific cancers where current options remain inadequate. Metastatic pancreatic ductal adenocarcinoma stands out as the most significant unmet need (52%), followed by pancreatic cancer broadly (38%) and gliomas (33%). This convergence highlights oncologists' dual challenge: achieving meaningful clinical outcomes in populations with historically poor prognoses.

Big Pharma Maintains Advantage

Large pharmaceutical companies continue to maintain a clear advantage in oncology pipeline perceptions. Eight of the ten highest-scoring assets originate from major players including Daiichi Sankyo, Merck, AbbVie, AstraZeneca, and Regeneron. This advantage suggests that corporate reputation, clinical development expertise, and marketing capabilities continue to play a significant role in shaping healthcare provider perceptions.

Leading Pipeline Assets: Current Frontrunners

Four assets have emerged as clear perception leaders among oncology pipeline perceptions peers, each demonstrating unique strengths that drive clinical enthusiasm

- HER3-DXd1 (Daiichi Sankyo) leads with a perception score of 62. This HER3-targeting ADC highlights Daiichi Sankyo's continued innovation in the ADC space.

- Sacituzumab tirumotecan (Merck) achieves an identical score of 62. This Trop-2 ADC leverages proven mechanisms while demonstrating strong clinical data

- Camizestrant (AstraZeneca) scores 42. This asset addresses critical needs in hormone receptor-positive breast cancer, particularly in advanced and treatment-resistant settings.

- Teliso-V2(AbbVie) achieves a score of 41. This c-Met targeting ADC offers potential benefits in lung cancer populations with specific molecular characteristics.

Implications for Marketers & ASCO 2025

As the industry approaches ASCO 2025, several key trends will likely dominate scientific discussions:

- Mechanism Innovation: Healthcare providers seem to favour novel approaches over incremental improvements. Marketing strategies should emphasize unique mechanisms and distinctive targeting approaches.

- Tolerability Focus: Clinical communications should feature safety profiles and quality-of-life benefits, particularly for challenging cancer populations.

- Perception Management: The need to balance awareness building with excitement generation, as successful pipeline positioning requires both

Looking Ahead: Competitive Landscape Evolution

The oncology pipeline offers unprecedented opportunity for meaningful treatment advances. Healthcare provider enthusiasm extends beyond efficacy metrics to encompass tolerability, mechanism novelty, and applicability to clinical scenarios.

While large pharmaceutical companies maintain perception advantages, genuine innovation and compelling clinical data can generate enthusiasm regardless of corporate size. The competitive landscape will continue evolving as these factors shape physician adoption patterns.

For detailed analysis & customized insights into oncology pipeline perceptions, contact:

Brooke Nelson | Senior Manager

brooke.nelson@zoomrx.com

Dan Callahan | Principal

dan.callahan@zoomrx.com

Note:

- BLA for Daiichi Sankyo’s Patritumab-DXd for EGFR-NSCLC withdrawn post study completion (on 29 May, 2025)

- FDA approved vimseltinib (on Feb 14,2025, marketed as Romvimza), avutometinib + defactinib (on May 8, 2025, marked as (Avmapki Fakzynja), and Teliso-V (on May 14,2025, marketed as Emrelis) during fielding.

Get in touch with us