Executive Summary

Healthcare professionals (HCPs) managing metastatic castration-resistant prostate cancer (mCRPC) are navigating an expanding array of early-line therapies, complicating brand visibility. The competitive landscape has intensified significantly following Pluvicto’s earlier placement in the treatment algorithm. Our analysis of real-time browsing data from 140 oncology HCPs, captured through ZoomRx Digital Journey, reveals significant shifts in which mCRPC therapies that are drawing the most online attention. It demonstrates how aggressive omnichannel marketing can boost awareness of new treatments, while also underscoring the challenges of maintaining long-term engagement in an evolving therapy area.

Key Findings

- Few brands break through. Outside of Xtandi, Pluvicto, and Lynparza, few therapies generate meaningful online engagement from HCPs.

- Xtandi remains the anchor. Despite a relatively smaller digital footprint, it continues to command the highest share of HCP attention online.

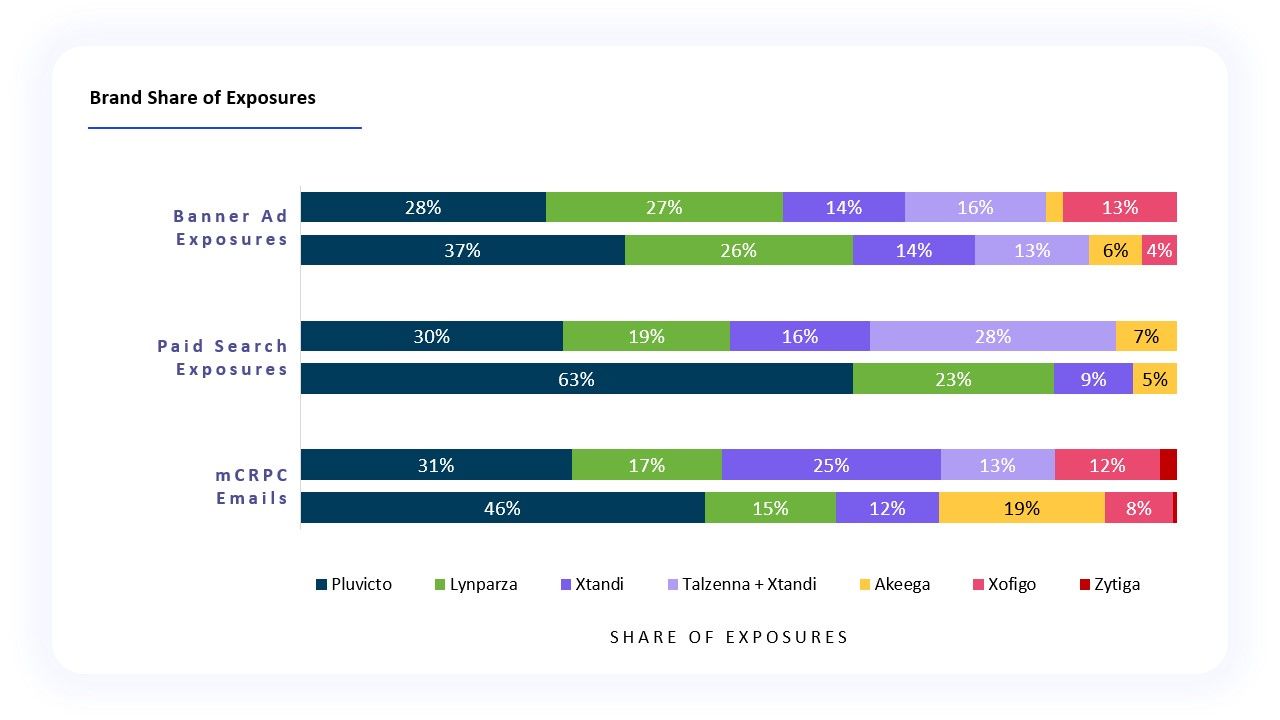

- Pluvicto surges ahead. An aggressive ramp-up across banner ads, paid search, and email has helped Pluvicto draw nearly twice as much HCP attention as Lynparza.

- Lynparza stays visible—but trails. While it has defended its digital banner ad, paid search, and email presence amid Pluvicto’s expansion, Lynparza trails Pluvicto across all three channels.

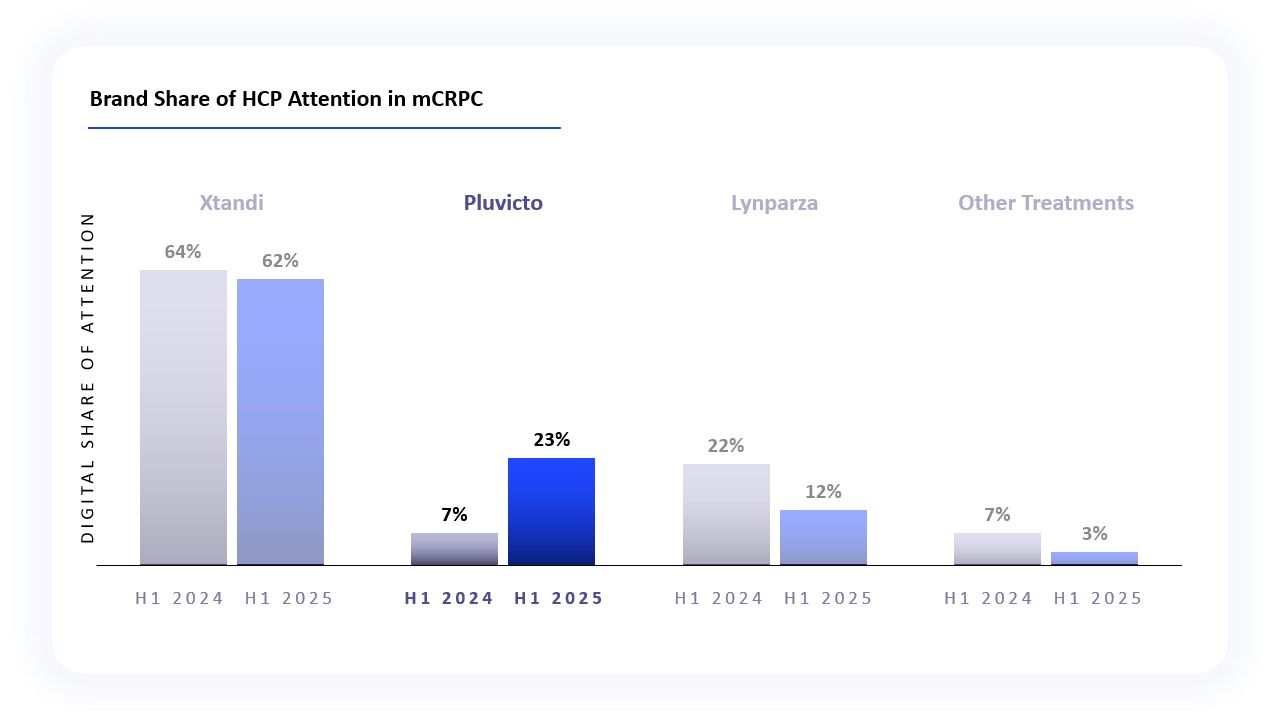

The Battle for Digital Mindshare

The mCRPC treatment landscape is becoming increasingly fragmented, intensifying competition for HCP attention. ZoomRx analyzed more than 2,000 online HCP browsing sessions related to mCRPC for the first half of 2024 and 2025, uncovering significant shifts. Most notably, Pluvicto more than tripled its share of digital attention, from 7% in H1 2024 to 25% in H1 2025, following an aggressive digital marketing campaign that emphasized its pre-taxane approval. This gain primarily impacted Lynparza, which lost nearly half its share of HCP attention YoY. Xtandi, however, maintained its strong position, consistently capturing over 60% of HCP attention in both periods.

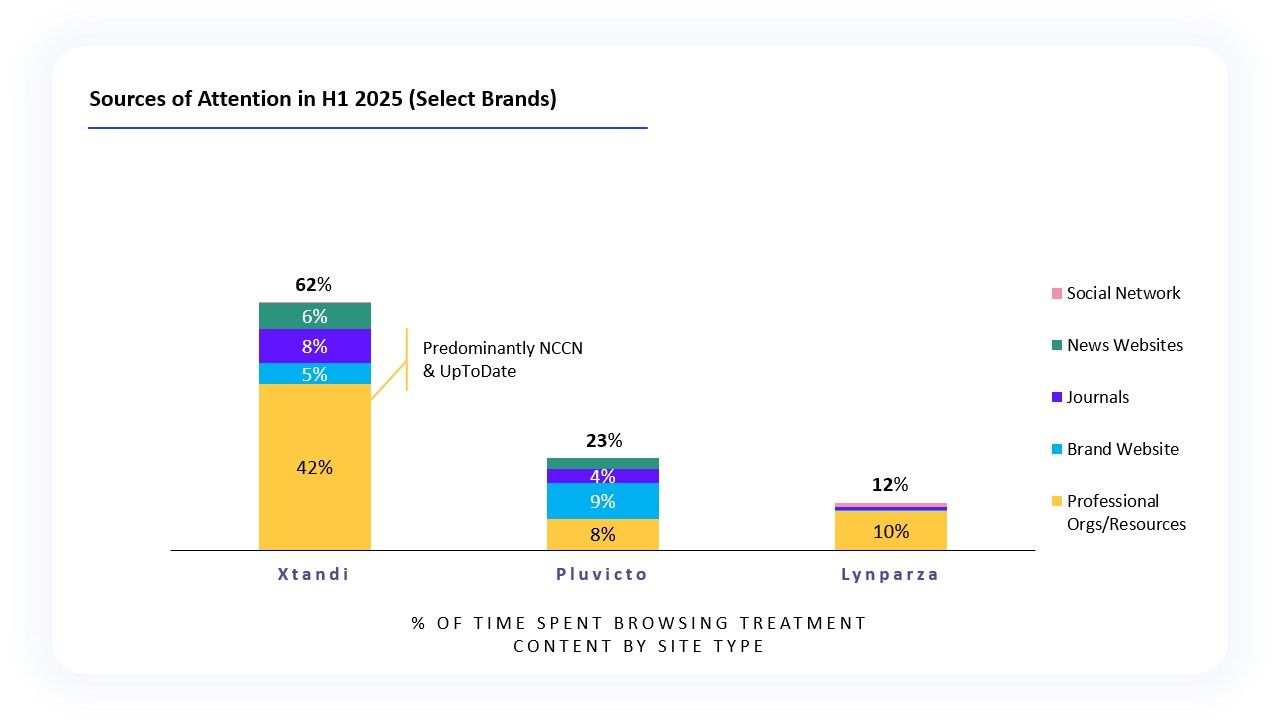

A closer look at where HCPs turn to for information in 2025 shows that HCPs predominantly rely on trusted clinical references, such as NCCN Guidelines and UpToDate. Xtandi notably benefits from its recognized status as a standard of care within these trusted sources. Meanwhile, nearly half of Pluvicto’s digital engagement occurs on its brand site, enabling the brand to control its messaging and reduce competitive distractions. Conversely, Lynparza’s dedicated product site has attracted relatively limited engagement, even falling behind Xtandi’s, highlighting how Pluvicto has effectively overshadowed Lynparza in the digital arena.

Digital Channel Strategies Driving Engagement

Pluvicto kicked off the year with an omnichannel blitz across banner ads, paid search, and email, and then reinforced its efforts into Q2. Paid search stood out, with exposure more than doubling from Q1 to Q2, driven by direct brand searches highlighting growing awareness of its new indication.

In response, Lynparza maintained its overall digital presence while strategically adjusting messaging to BRCA-specific content. Despite its repositioning, the brand attracted relatively little attention.

Lynparza Messaging

- Q1 2025 Broader Messaging: Combination therapy for certain patients with metastatic prostate cancer.

- Q2 2025 Shift to BRCA-Focused Messaging: Targeted treatments available for adults with a BRCA mutation.

Xtandi, meanwhile, maintained strong visibility through banner ads across its standalone Xtandi and co-branded Talzenna campaigns but ceded ground to competitors in paid search and email channels. Nevertheless, Xtandi sustained the highest share of digital attention due to its well-established position across multiple prostate cancer indications and its prominence within NCCN and UpToDate resources.

Lessons for Marketers

Successfully navigating the fragmented mCRPC digital landscape demands a nuanced strategy that blends aggressive marketing efforts with sustained clinical credibility. Our findings demonstrate that a well-timed digital push, combined with recognition in authoritative clinical resources, establishes a lasting advantage in digital mindshare.

- Temporary gains from omnichannel strategies. Bold, multi-channel initiatives can effectively disrupt crowded markets but must be continuously reinforced.

- Clinical credibility endures long-term. Embedding brands deeply into trusted decision-support platforms provides resilience against competitive pressures.

- Digital attention is easily lost. Regaining lost digital momentum requires significant effort and investment, underscoring the importance of consistent engagement.

Get in touch with us: