Eli Lilly’s GLP-1 Push and Specialty Drugs Reshape the Pharma Digital Ad Battleground

Digital advertising continues to play a defining role in shaping pharmaceutical brand visibility - and in Q3 2025, a few powerhouse manufacturers dominated the digital landscape. ZoomRx’s latest analysis reveals that banner ad impressions are increasingly concentrated among a handful of top players, with Eli Lilly, J&J, Pfizer, and AstraZeneca leading the charge.

This quarter’s data paints a clear picture: pharma’s digital investments are becoming more focused, more strategic, and more concentrated around high-value therapeutic categories.

In a Nutshell

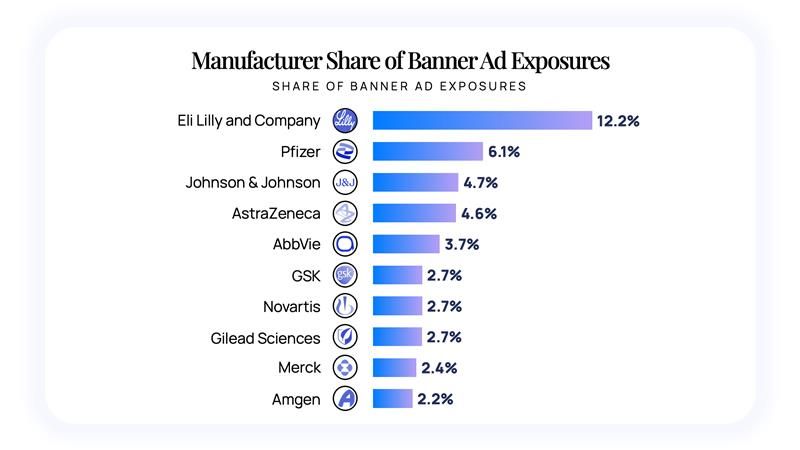

- The top 10 manufacturers captured 44% of all pharmaceutical banner ad exposures in Q3, led by Eli Lilly, Pfizer, J&J, and AstraZeneca.

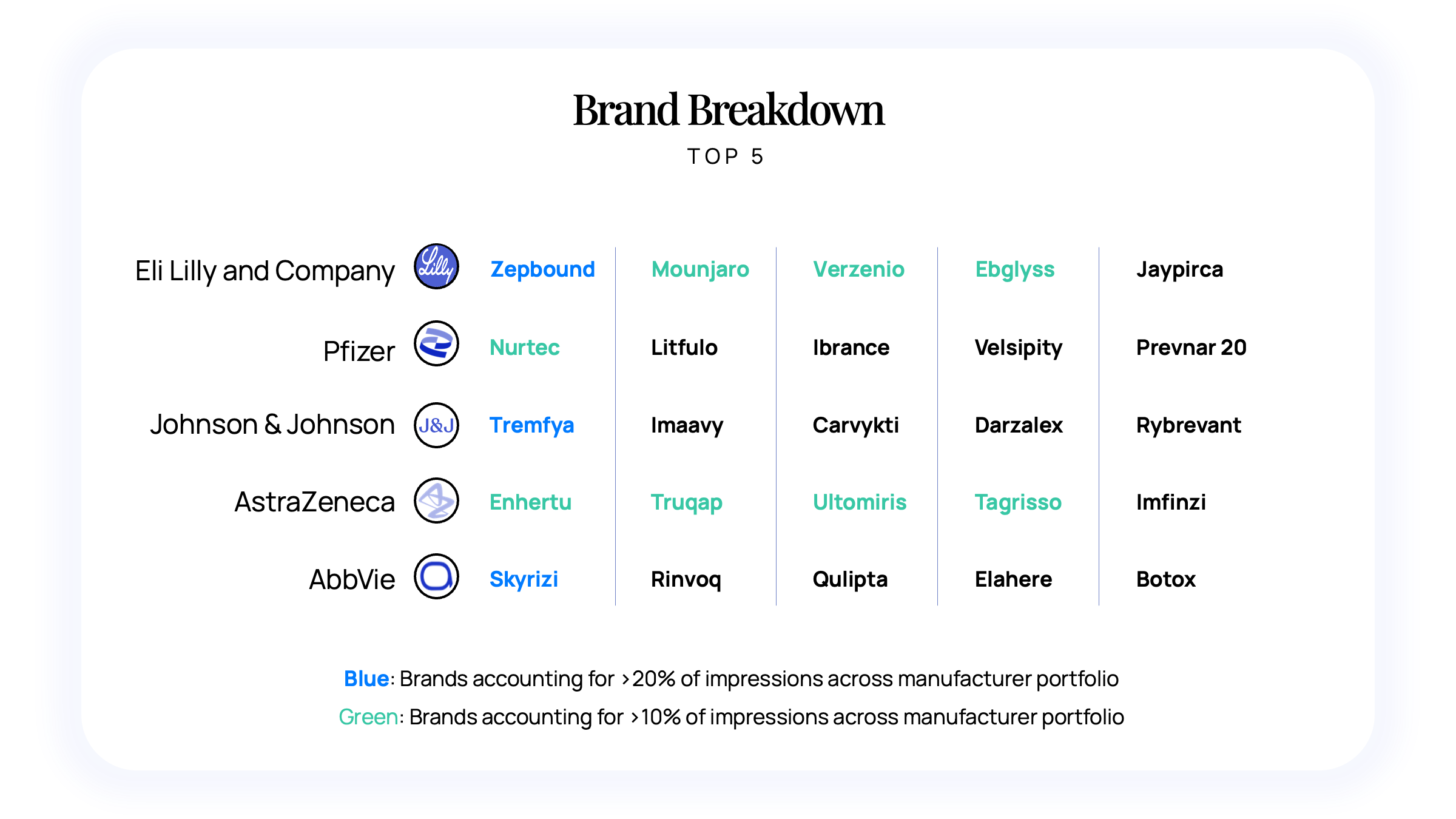

- Eli Lilly’s GLP-1 portfolio — Zepbound and Mounjaro — drove nearly half of the company’s digital investment, solidifying its position as a metabolic powerhouse.

- Competitors are following suit, with specialty drugs in immunology and oncology (Tremfya, Skyrizi, Truqap, Enhertu) commanding much of their spend.

- Smaller manufacturers face an increasingly fragmented and competitive digital environment, where visibility requires outsized investment.

Pharma Banner Ads in Q3 2025: A Concentrated Battleground

Pharmaceutical banner advertisements have become a standard feature of the digital healthcare experience. In Q3 2025, ZoomRx tracked over 91,000 real-time HCP exposures to banner ads — and the findings reveal a striking concentration of advertising activity.

The top 10 manufacturers accounted for nearly half of all banner ad impressions, signaling a deliberate pivot toward concentrated digital dominance. Rather than dispersing investment across a broad range of brands, leading companies are building digital fortresses around flagship therapies and franchise-defining categories.

The strategic intent is clear: secure category leadership in high-value therapeutic areas.

Major Pharma Companies Capture Most Digital Advertising Exposures

Banner ads remain a critical battleground for attracting HCP attention — and the latest pharmaceutical ad exposure insights reveal a clear hierarchy among manufacturers.

The top five companies together accounted for nearly one in every three exposures, with Eli Lilly alone commanding 12.2% of all banner ad impressions — roughly equal to the combined share of GSK, Novartis, Gilead, Merck, and Amgen.

Smaller manufacturers, by contrast, face a fragmented digital landscape. Their exposures are widely dispersed, making it increasingly challenging to compete for visibility without significant media investment.

This concentration underscores how the biggest players are leveraging targeted digital campaigns to dominate share of voice and brand recall among healthcare professionals.

High-Value Specialty Drugs Drive Digital Advertising Strategy

Pharma’s digital marketing trends are now being shaped around therapeutic depth rather than portfolio breadth. Top manufacturers are consolidating their investments in core therapeutic areas: Eli Lilly in metabolic, J&J and AbbVie in immunology, and AstraZeneca in oncology.

Here’s how these leaders are defining their digital strategies:

- Eli Lilly: Zepbound captured 29% of the company’s banner ad impressions and Mounjaro 15%. Together, they accounted for nearly half of Lilly’s total impressions — reinforcing its leadership in metabolic disease.

- Johnson & Johnson / AbbVie: Both companies doubled down on immunology. J&J centered its spend on Tremfya, while AbbVie split its post-Humira strategy between Skyrizi (26%) and Rinvoq (14%).

- AstraZeneca: Oncology precision medicines like Truqap (19%) and Enhertu (19%) dominated AstraZeneca’s digital focus.

In Conclusion

Pharma’s digital advertising in Q3 2025 was defined by concentration and category leadership. Leading manufacturers are channeling their banner ad budgets toward breakthrough and specialty therapies, reinforcing their therapeutic dominance and long-term brand positioning.

Eli Lilly’s GLP-1 franchise exemplifies this evolution — demonstrating how sustained digital focus can cement leadership in an emerging therapeutic space. Competitors like J&J, AbbVie, Pfizer, and AstraZeneca are following similar paths in immunology and oncology, respectively.

The outcome: a fragmented yet fiercely competitive digital ecosystem, where visibility increasingly belongs to those who invest deeply in their chosen therapeutic categories.

The takeaway: pharma’s digital future lies in precision marketing - targeted campaigns anchored around category leadership, brand differentiation, and long-term therapeutic bets.

Data Source:

This analysis by ZoomRx examined pharmaceutical banner advertising data from July 1 to September 30, 2025, tracking real-time digital ad exposures among 540 HCPs across multiple specialties. All data were sourced from the ZoomRx Digital Tracker.

Get in touch with us:

Frequently Asked Questions

What is the importance of banner advertising in pharma digital marketing?

Banner ads remain a key component of pharma digital advertising strategies, offering consistent visibility to healthcare professionals and measurable engagement across digital channels.

Which pharma companies led banner ad share in Q3 2025?

According to ZoomRx pharmaceutical ad spend insights, Eli Lilly, Johnson & Johnson, Pfizer, and AstraZeneca captured the majority of digital banner ad exposures among top pharmaceutical manufacturers.

Why are specialty drugs receiving more digital ad spend?

Pharma companies are prioritizing high-value categories like immunology, oncology, and metabolic care because they align with precision medicine and long-term treatment potential.

How can smaller pharma brands improve digital visibility?

Smaller manufacturers can compete through hyper-targeted digital strategies, data-driven ad placements, and creative storytelling that differentiates their brands within niche therapeutic areas.