Genentech and Jazz tops among the list of most exciting oncology pipeline assets

The Future of Oncology: Which Treatments Excite Oncologists?

In the ever-evolving landscape of cancer treatment, the pipeline of new therapies holds the key to future breakthroughs. But which upcoming treatments are capturing the attention and excitement of oncologists? A recent study by ZoomRx, the leading strategic life sciences consulting firm provides valuable insights into the perceptions of oncology pipeline assets, offering a glimpse into the treatments that may shape the future of cancer care.

Methodology: Capturing the Pulse of the Oncology Pipeline

In June 2024 shortly after ASCO, ZoomRx conducted a comprehensive survey of 65 US oncologists, all of whom were familiar with oncology pipeline treatments. The study tracked perceptions of over 30 solid tumor pipeline assets with expected launches in 2025-2026. By measuring awareness, excitement, and familiarity with clinical trials, the study created a "perception score" for each asset, providing a snapshot of which treatments are generating the most buzz among oncologists.

Teliso-V, Tiragolumab and Zanidatamab Generating Excitement

Three treatments emerged as clear frontrunners in the study:

- Telisotuzumab vedotin (Teliso-V) topped the list with the highest perception score. This c-Met protein directed antibody-drug conjugate (ADC) is generating excitement for its novel mechanism of action and promising efficacy in treating certain types of lung cancer.

- Genentech’s Tiragolumab secured the second spot. As an anti-TIGIT antibody, it represents a new approach to checkpoint inhibition, potentially enhancing the effectiveness of immunotherapies.

- Jazz’s Zanidatamab rounded out the top three. This HER2-bispecific antibody is drawing attention for its potential in treating various HER2-positive cancers.

What Drives Oncologist Excitement?

The study revealed several key factors that influence oncologists' perceptions of pipeline assets:

- Novel Mechanisms of Action: Treatments that offer new ways to target cancer cells or enhance the immune system's response consistently ranked high in perception scores.

- Strong Clinical Data: Assets with robust and promising clinical trial results naturally generated more excitement among oncologists.

- Addressing Unmet Needs: Treatments targeting cancers with limited current options or showing efficacy in treatment-resistant populations were viewed more favorably.

- Improved Tolerability: Assets that promise similar or better efficacy with reduced side effects compared to existing treatments garnered significant interest.

The Impact of Big Pharma

The study revealed a clear advantage for assets developed by major pharmaceutical companies. Of the top six assets with the highest perception scores, five came from industry giants like Genentech, AstraZeneca, Lilly, and Amgen. This suggests that factors such as reputation, resources for clinical development, and marketing capabilities play a significant role in shaping oncologist perceptions.

Beyond the Top Three: Hidden Gems and Dark Horses

While the top three assets garnered the most attention, several other treatments showed potential to be game-changers: GSK’s Cobolimab, Immutep’s Eftilagimod, Genelux’s Olvimulogene, and Chimerix’ Dordaviprone were identified as potential dark horse candidates. Despite lower overall familiarity, oncologists who were aware of these treatments often viewed them as potential paradigm-shifters.

Assets from smaller biotechs, while generally scoring lower in overall perception, often showed promise in niche areas or novel approaches, highlighting the importance of innovation regardless of company size.

Tier 1: Top 10 Most Exciting Oncology Assets

In addition to the top 3, AstraZeneca’s Camizestrant, Lilly’s Imlunestrant and Amgen’s Bemarituzumab performed very well in our survey.

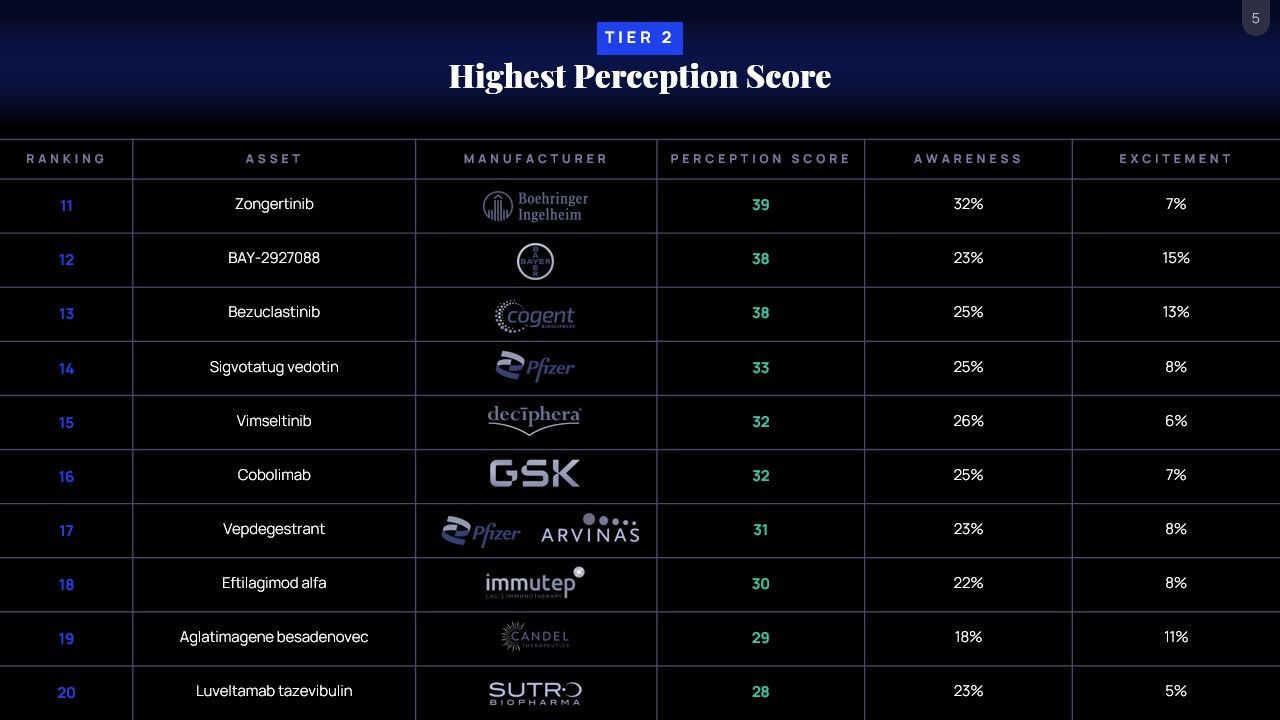

Tier 2: Middle 11 – 20 Assets

Boehringer Ingleheim’s Zongertinib, Bayer’s BAY-88 and Cogent’s Bezuclastinib land in our middle tier alongside with an impressive list of assets.

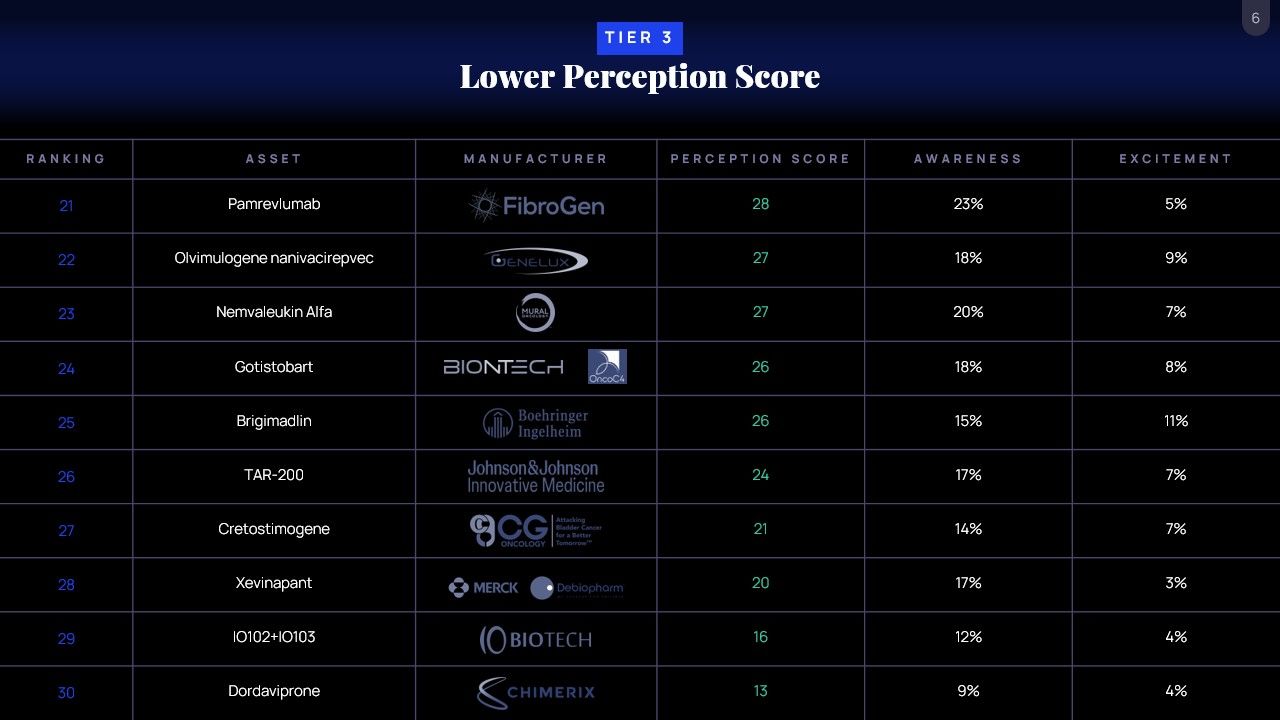

Tier 3: Bottom 10 Assets

Several assets in our lowest cohort are being developed by smaller biotechs including Pamrevlumab by FibroGen, Olvimulogene by Genelux and Nemvaleukin by Mural.

Looking Ahead: Implications for the Oncology Landscape

As these pipeline assets move closer to potential approval and launch, several implications emerge for various stakeholders:

- For Oncologists: Staying informed about these emerging treatments will be crucial for providing cutting-edge care to patients.

- For Patients: The pipeline offers hope for new, potentially more effective or better-tolerated treatment options across various cancer types.

- For Pharmaceutical Companies: Understanding what drives oncologist excitement can inform R&D priorities and communication strategies for pipeline assets.

- For Investors: Perception scores could serve as one indicator (among many) of an asset's potential market reception upon approval.

Conclusion: A Dynamic Future for Cancer Treatment

The oncology pipeline perceptions study offers a window into the future of cancer treatment. With novel mechanisms of action, promising efficacy data, and the potential to address significant unmet needs, these pipeline assets represent the next wave of innovation in oncology. As the field continues to evolve rapidly, staying attuned to oncologist perceptions will be crucial for all stakeholders in the fight against cancer.

While perceptions can change as more data becomes available, this snapshot provides valuable insights into the treatments that may soon be reshaping the oncology landscape. The future of cancer care looks bright, with a rich pipeline of innovative therapies poised to offer new hope to patients and oncologists alike.

Get in touch with us for more information

For questions or additional information about this study, please contact Dan Callahan at dan.callahan@zoomrx.com and Manoj Hariharaputhiran at manoj.hariharaputhiran@zoomrx.com.