Following our prior analysis of overarching trends in healthcare professional (HCP) message recall and effectiveness across the pharmaceutical market, we’ve now explored three key therapeutic areas in greater depth: Oncology, Rare Disease, and Immunology. This closer look provides a more detailed view of how brand messages perform within these specific contexts. Consistent with our earlier findings, the general patterns largely hold true; however, each therapeutic area presents its own unique dynamics that influence message reception and impact. These insights offer a refined perspective for pharmaceutical companies aiming to optimize their strategies and strengthen HCP engagement in these vital areas.

- In Oncology, Innovation and Clinical-focused messages (Efficacy, Patient Type) resonate the most due to the highly competitive and rapidly evolving market

- In Immunology, Practical usability and Patient-Centricity (Convenience, MOA, Dosing) drive engagement, aligning with the chronic nature of these diseases.

- In Rare Disease, Indication & Guideline take precedence as clear treatment protocols and defining standards of care are essential for navigating these complex conditions.

These insights offer clarity for Pharma commercial and insights teams seeking to optimize field force messaging strategies. By understanding what truly connects with HCPs in each therapeutic area, companies can fine tune their messaging to foster deeper, more impactful relationships. We explore these dynamics, providing actionable takeaways to elevate your brand's communication

We used the ZoomRx Promotional Tracking Industry benchmarks for message recall and effectiveness in:

- Oncology (>3000 oncology messages for > 115 oncology brands)

- Immunology (>900 messages for > 35 immunology brands)

- Rare Disease (>500 messages for > 30 rare disease brands)

Our findings highlight:

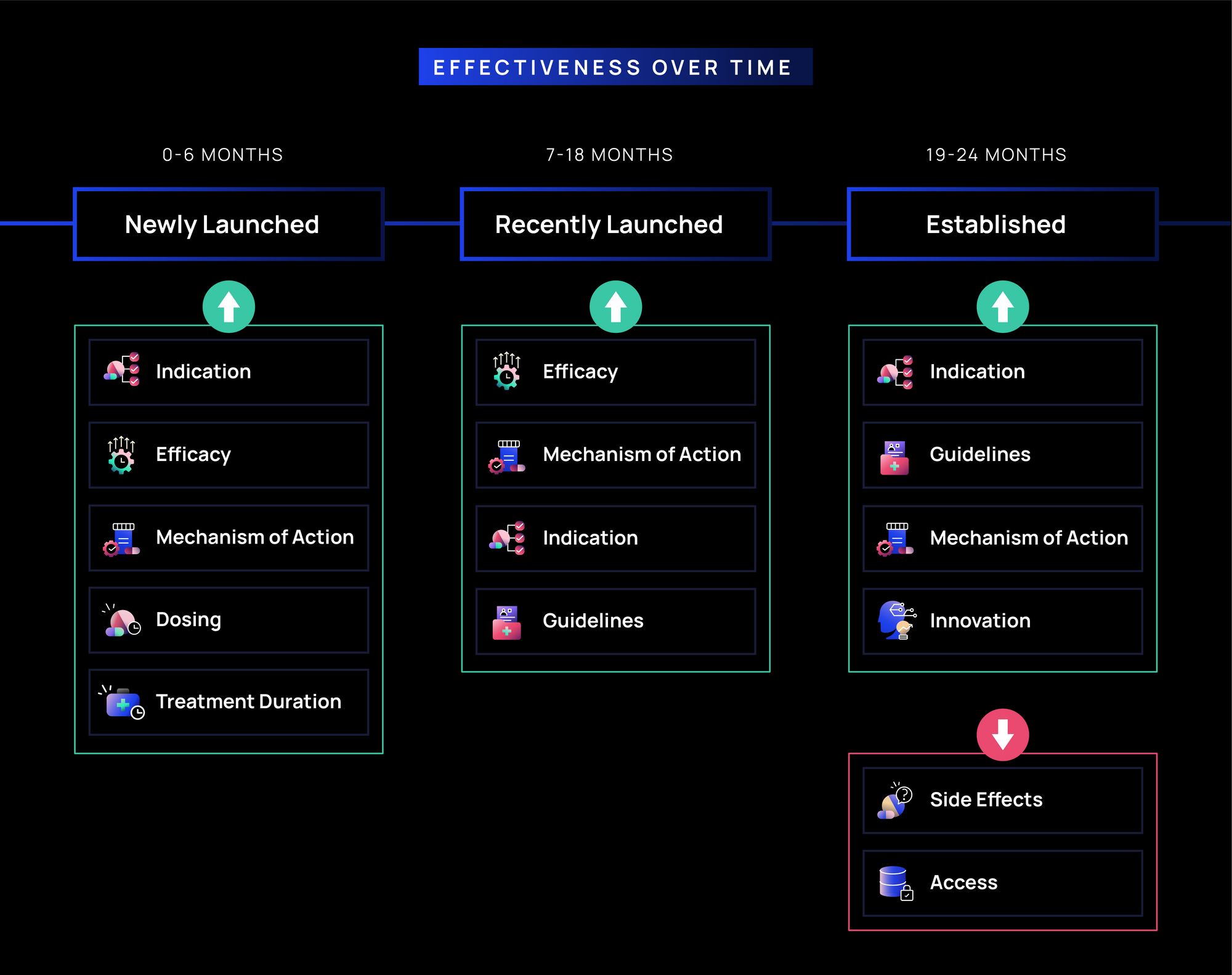

- How message themes (i.e., efficacy, indication, MOA) impact recall & effectiveness overall

- How message recall & effectiveness evolve across a product’s launch lifecycle: newly launched (0-6 months), recently launched (7-18 months), and established (19-24 months)

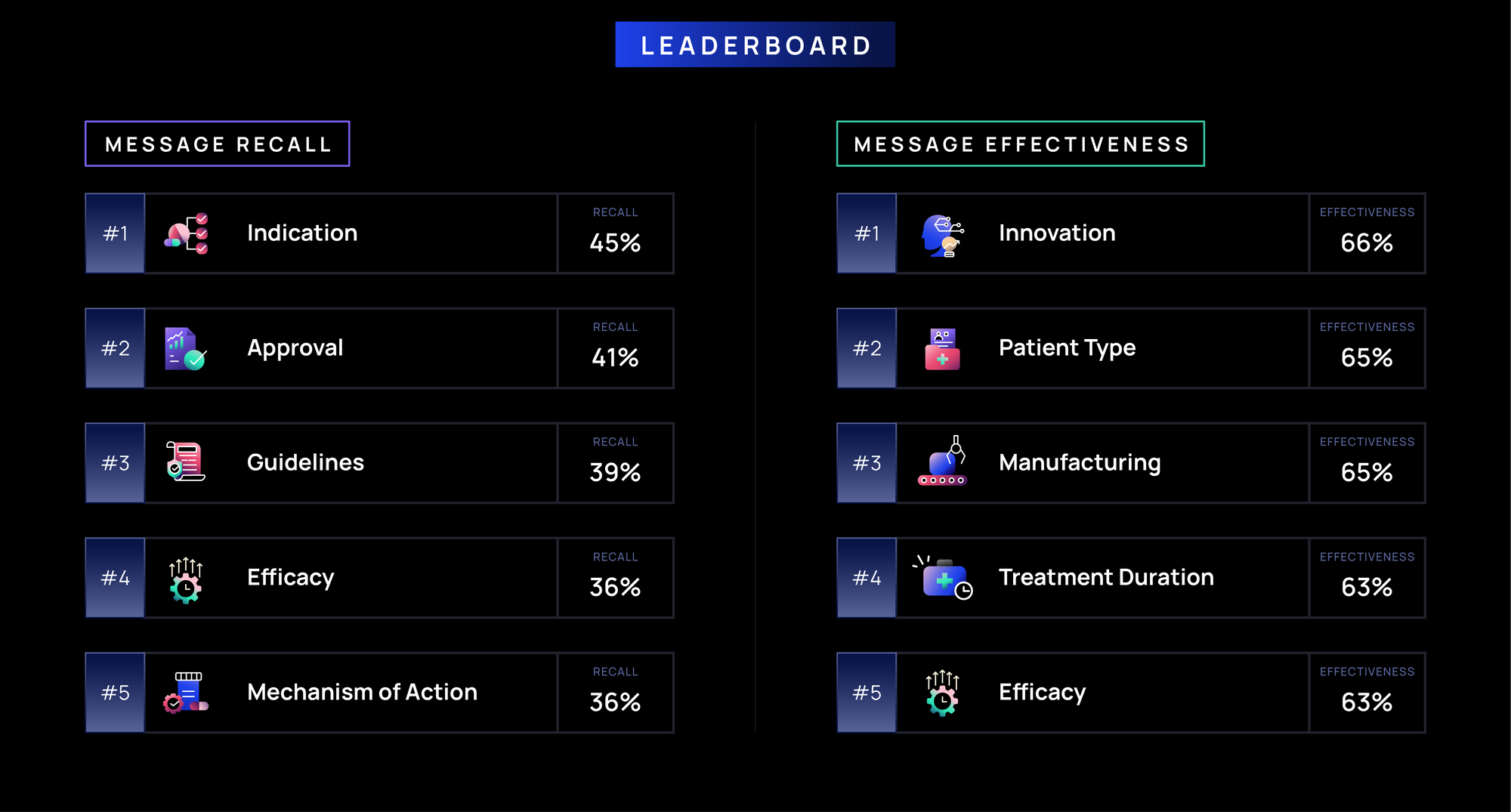

Oncology Benchmarks Sub-Analysis

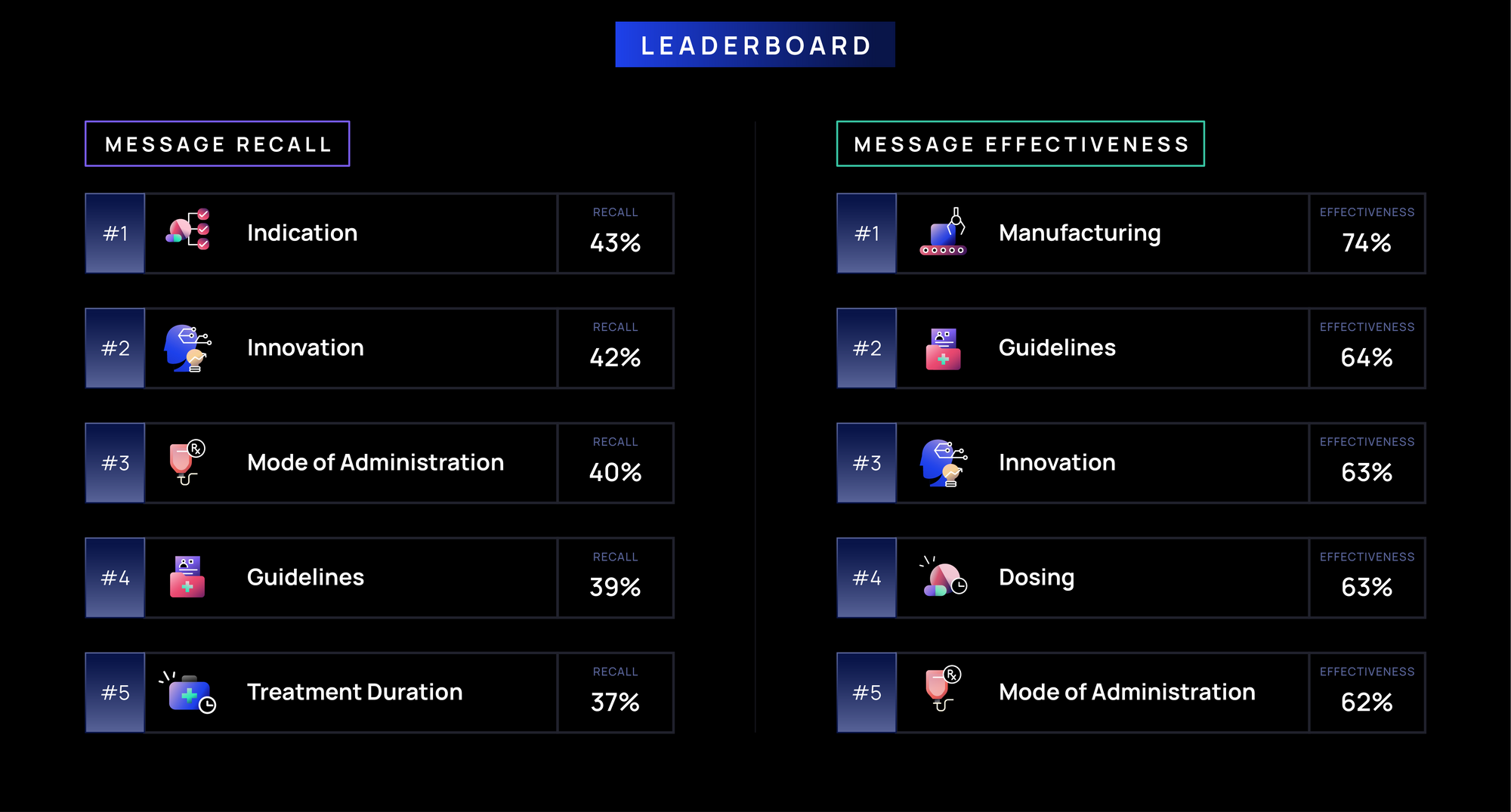

Recall:

- Foundational brand messages (e.g., Indication, Approval) are recalled most often (>40%), highlighting their role in defining a brand’s identity by establishing when and for whom a drug is used, while reinforcing credibility via guidelines.

- Messages highlighting a brand’s clinical profile (e.g., Efficacy, MOA, Innovation) and treatment logistics (e.g., Manufacturing, Treatment Duration, Marketing, Administration) have moderate recall (30-40%), likely reflecting their influence on oncologists’ prescribing decisions.

- Messages related to Side Effects, Access (e.g., Insurance Coverage, Patient Support), and Patient Considerations (e.g., Testing, Patient Type) have lower recall (less than 30%), possibly due to their lower relevance in immediate prescribing decisions or applicability to other healthcare stakeholders.

Effectiveness:

- Innovation, Patient Type, and Manufacturing messages (>65%) are most effective, likely due to their role in treatment differentiation, patient selection, and ensuring product availability.

- Messages on treatment decision-making and brand positioning (e.g., Marketing, Approval, Efficacy, Duration, Indication; ~60-63%) are moderately effective, reinforcing relevance but less likely to shift prescribing behavior.

- Side Effects, Access (e.g., Insurance Coverage, Patient Support), and Patient Considerations (e.g., Testing, Patient Type) (less than 60%) are least effective; side effects messages often highlight risks over benefits, while access and support topics may fall outside oncologists' direct influence, limiting impact.

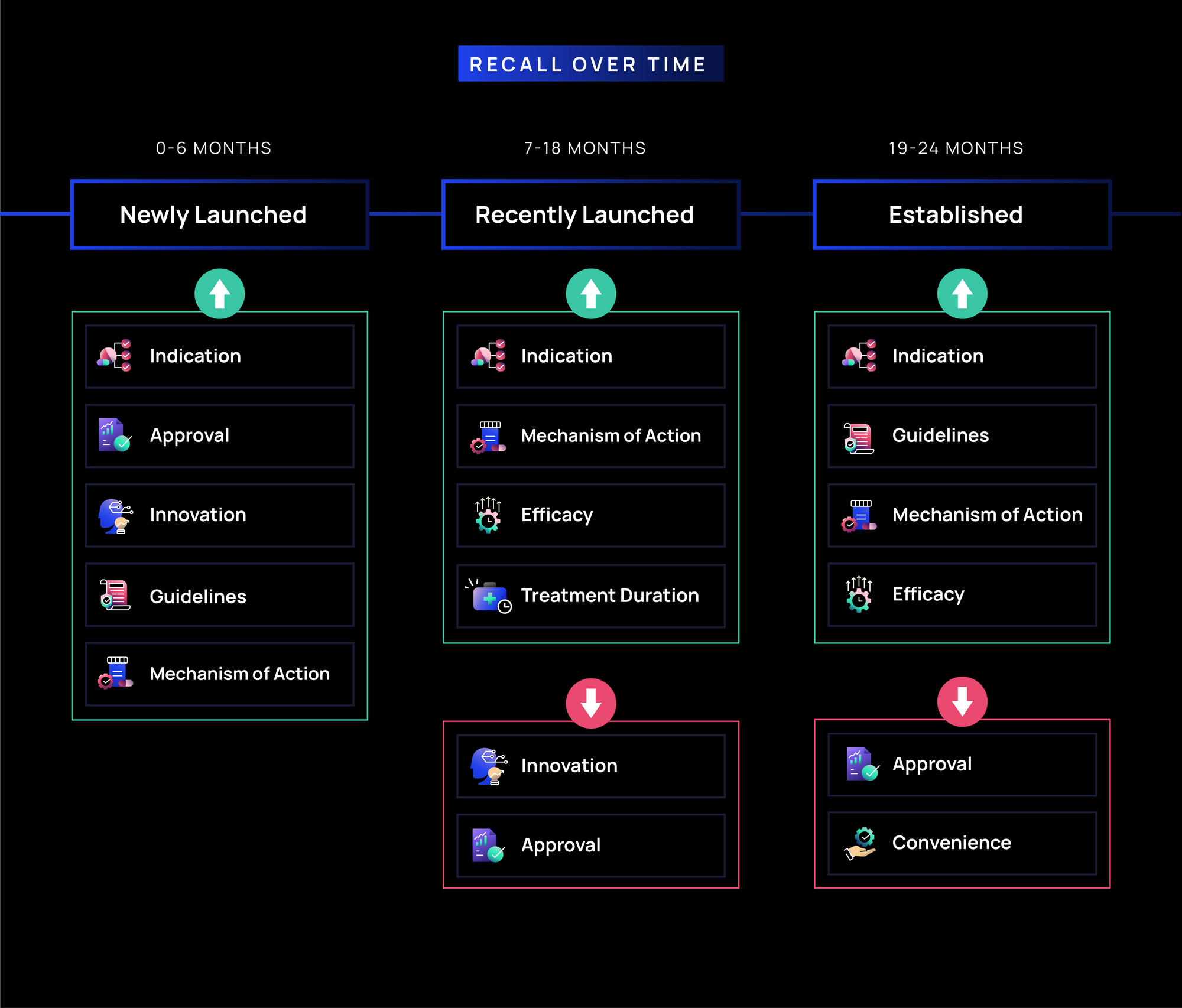

Recall Over Time in Oncology:

- Newly Launched (0-6 months): Messages related to Indication, Approval, Innovation, Guidelines, and MOA drive the strongest recall (~45-50% on average), suggesting early promotional efforts emphasize foundational awareness, credibility, and differentiation, which are critical in shaping initial oncologist engagement.

- Recently Launched (7-18 months): Recall of Approval and Innovation soften, while Indication, MOA, Efficacy, and Treatment Duration remain steady (~35-40%). As brands move into this phase, oncologists are likely already familiar with foundational messages and shift their focus to clinical differentiation and treatment decision-making.

- Established (19-24 months): Over time, recall of Approval and Convenience decline, while Indication, Guidelines, MOA, and Efficacy remain the most consistently recalled messages (~35-40%). This suggests that as HCPs gain more familiarity, they may rely less on broad access and indication/approval messaging and instead focus more on aspects related to clinical decision-making.

Effectiveness Over Time in Oncology:

- Newly Launched (0-6 months): Messages pertaining to Innovation, Mechanism of Action, and Unmet Need are most effective (>65%) immediately post-launch, likely because they provide early education on the treatment’s differentiation and function.

- Recently Launched (7-18 months): Message effectiveness tends to remain consistent throughout the first 18 months, with Mechanism of Action declining slightly; clinical messages (e.g., Duration, Efficacy, Indication, Patient Type) are also highly effective (60-65%) for building confidence and justifying usage with oncologists beyond early adopters.

- Established (19-24 months): By this point, effectiveness for Innovation, Approval, and Mechanism of Action decline, as oncologists likely gain familiarity with the brand. Messages pertaining to Access and Insurance tend to be low or decline as well (less than 60%), since this information likely becomes a background consideration and may be more relevant for other clinical staff. Unmet Needs and clinical messages (Efficacy, Patient Type, Indication, Duration) continue to resonate the most.

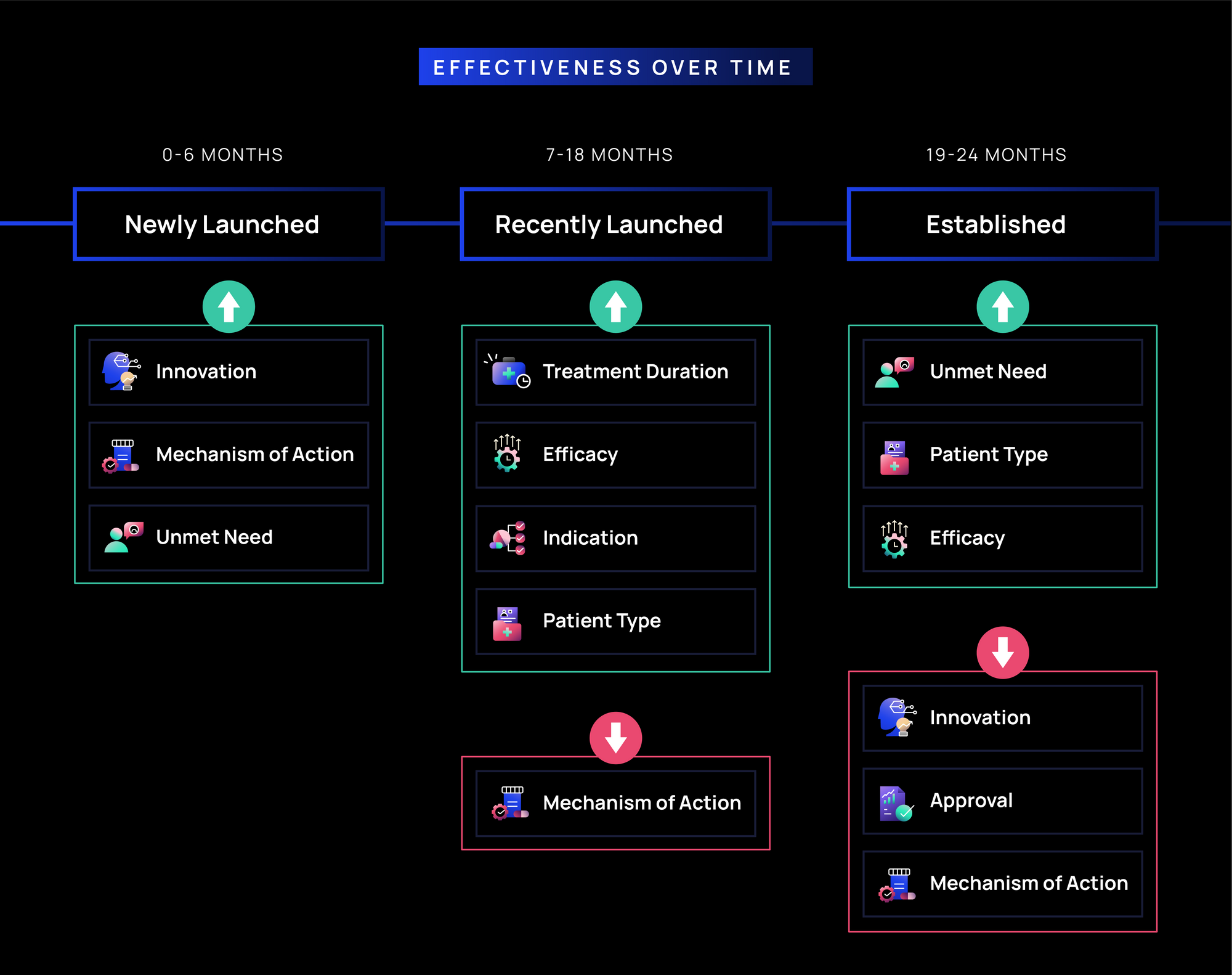

Immunology Benchmarks Sub-Analysis

Overall Key Findings by Theme in Immunology:

Recall:

- Clinical differentiation and treatment decision-making messages (e.g., MOA, Innovation, & Indication) drive the highest recall (>45%), as immunologists prioritize understanding how a therapy works and its role in patient management.

- Dosing, Convenience, and Guidelines (~40-45%) also see strong recall, likely highlighting the importance of flexible administration, treatment feasibility, and the need for clear protocols to navigate an evolving immunology landscape.

- Efficacy, Mode of Administration, and Disease State messages see lower recall (~35%) as immunologists focus more on treatment practicality and patient selection, with administration and disease state being less differentiating to immunologists given their familiarity and deep expertise in treating chronic conditions.

Effectiveness:

- Ease-of-use and patient-centered messages (e.g., Convenience, Patient Types, MOA) are most effective (>65%), reflecting immunologists’ focus on long-term disease management, treatment practicality, and understanding a therapy’s mechanism to optimize patient outcomes.

- Treatment practicality & differentiation messages (e.g., Dosing, Innovation, and Treatment Duration) are moderately effective (~60-65%), as immunologists prioritize therapies that are easy to administer, offer sustained efficacy, and stand out in an evolving treatment landscape.

- Foundational credibility messages (e.g., Approval, Indication, Guidelines, Efficacy) (~60%) reinforce confidence in a therapy but serve as a complement to more immediate prescribing considerations.

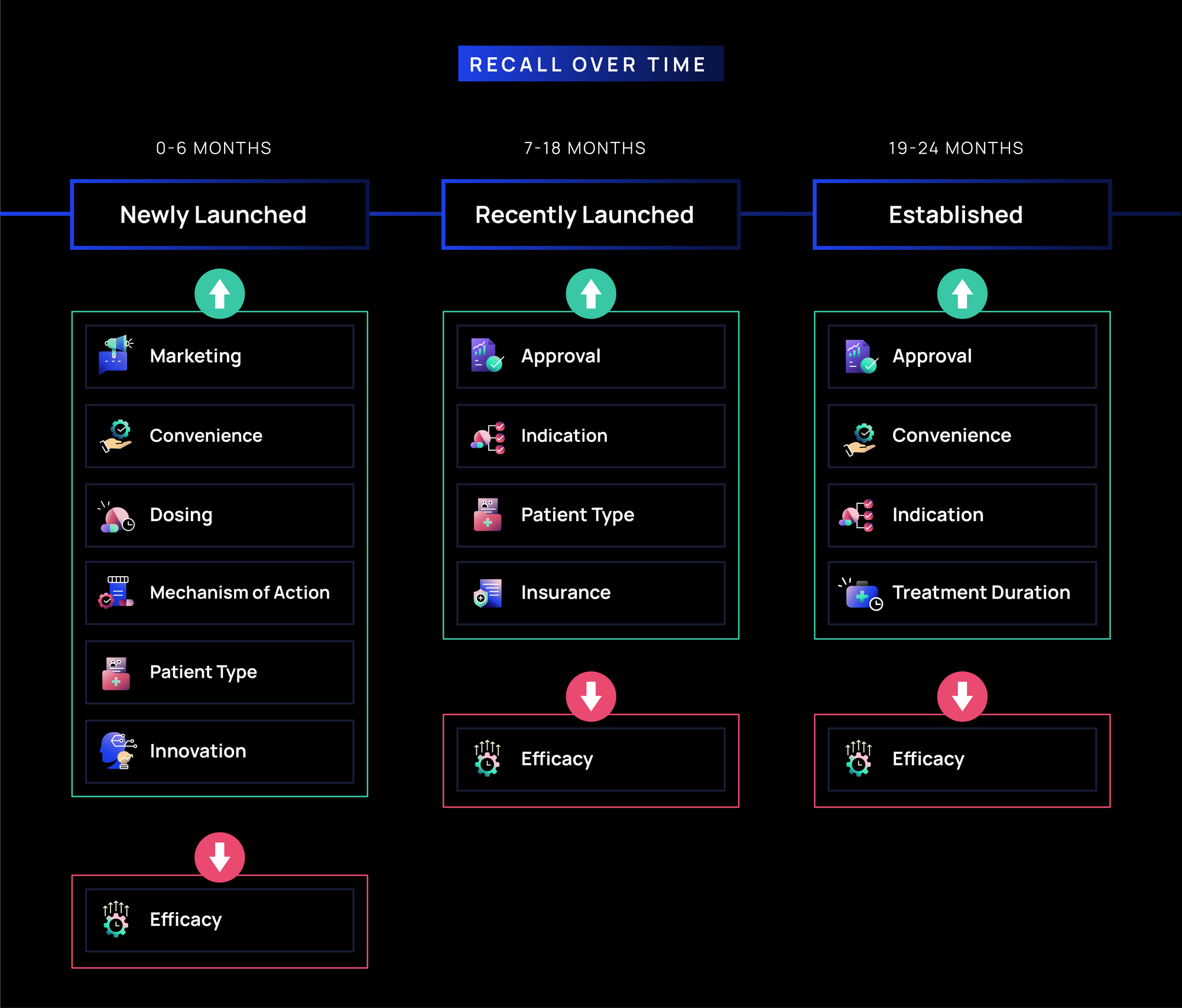

Recall Over Time in Immunology:

- Newly Launched (0-6 months): Marketing, Convenience, and Dosing drive the highest recall (~55-60%), as immunologists focus on awareness, ease of use, and administration. MOA, Patient Type, and Innovation (~45-55%) follow, reflecting interest in treatment mechanism and patient selection, while Efficacy recall is lower (~40%) suggesting that messaging on awareness and practicality is more memorable than those on clinical differentiation in the first few months of launch.

- Recently Launched (7-18 months): Recall of Marketing related messages softens, while Approval, Indication, and Patient Type (~50%) messages gain traction as immunologists assess real-world use. Messaging related to Insurance gains traction (~45%) as access becomes more relevant, while Efficacy remains lower (~30%), reinforcing that usability may be more top-of-mind for immunologists than continued efficacy messaging.

- Established (19-24 months): Approval and Convenience messages remain highly recalled (~55-60%), reinforcing their long-term relevance. Messages related to Indication and Treatment Duration move up in recall (~50%), suggesting HCPs are now considering long-term treatment planning and patient continuity. Efficacy recall remains low (~30%), reinforcing that in Immunology, treatment consideration may be more influenced by practical factors than continued efficacy messaging.

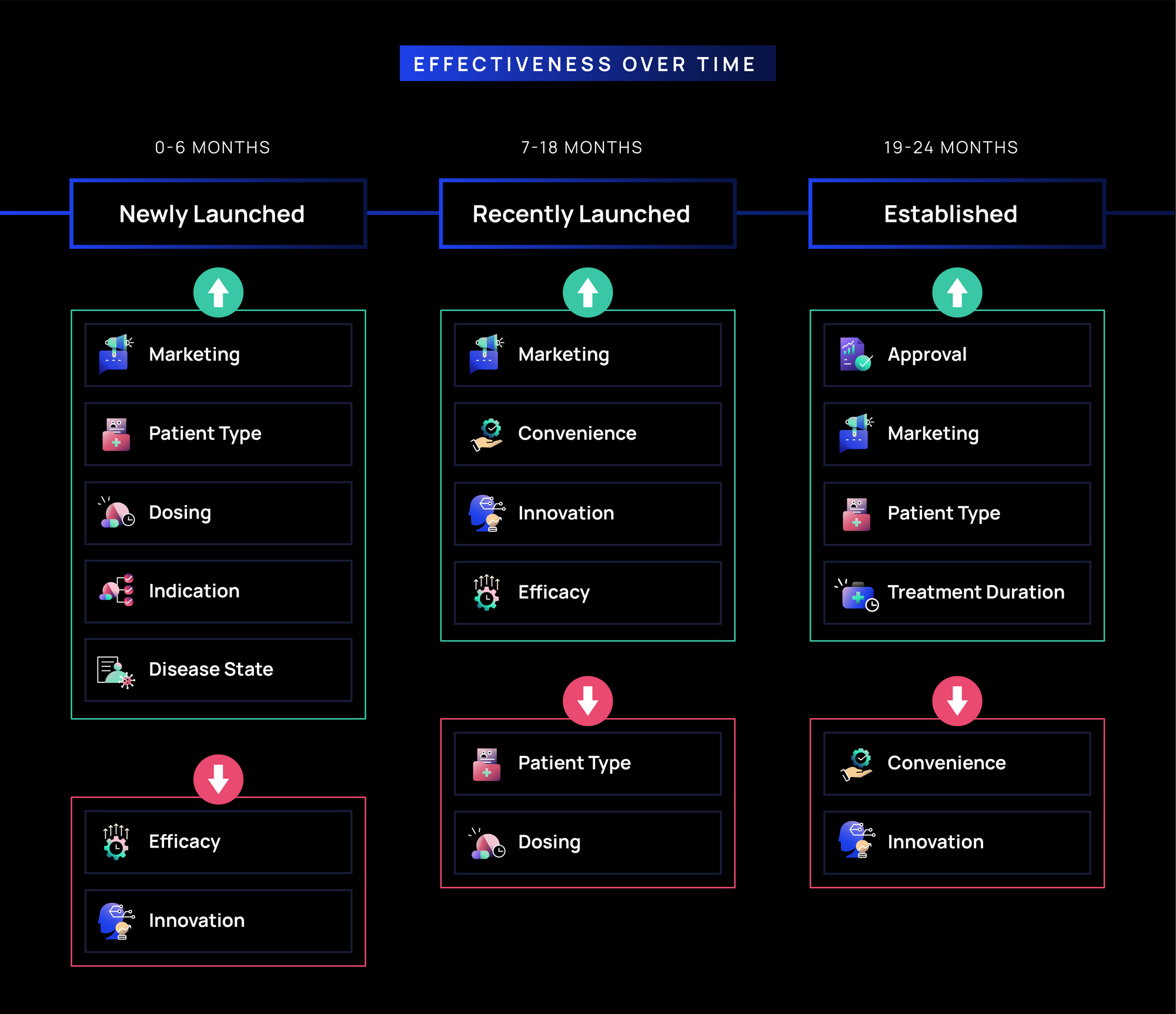

Effectiveness Over Time in Immunology:

- Newly Launched (0-6 months): Marketing and Patient Type (~75-80%) messages are the most effective, reinforcing early focus on brand awareness and defining the right patient population. Dosing, Indication, Disease State (~70%) are also highly effective, reflecting immunologists’ need to understand treatment applicability and administration. Efficacy and Innovation (~65%) messages are moderately effective, suggesting clinical differentiation is relevant but secondary to ease of use and positioning within treatment pathways.

- Recently Launched (7-18 months): Marketing (~75%) remains highly effective, while Convenience, Innovation, and Efficacy (~65-70%) gain effectiveness, reflecting a stronger focus on usability and treatment outcomes. Meanwhile, Patient Type and Dosing soften slightly as immunologists shift from initial patient identification to broader real-world application.

- Established (19-24 months):Approval, Marketing, Patient Type messages remain highly effective (>70%), likely supporting brand presence and patient selection. Convenience and Innovation message effectiveness softens, while Treatment Duration (~65%) messages are increasingly effective.

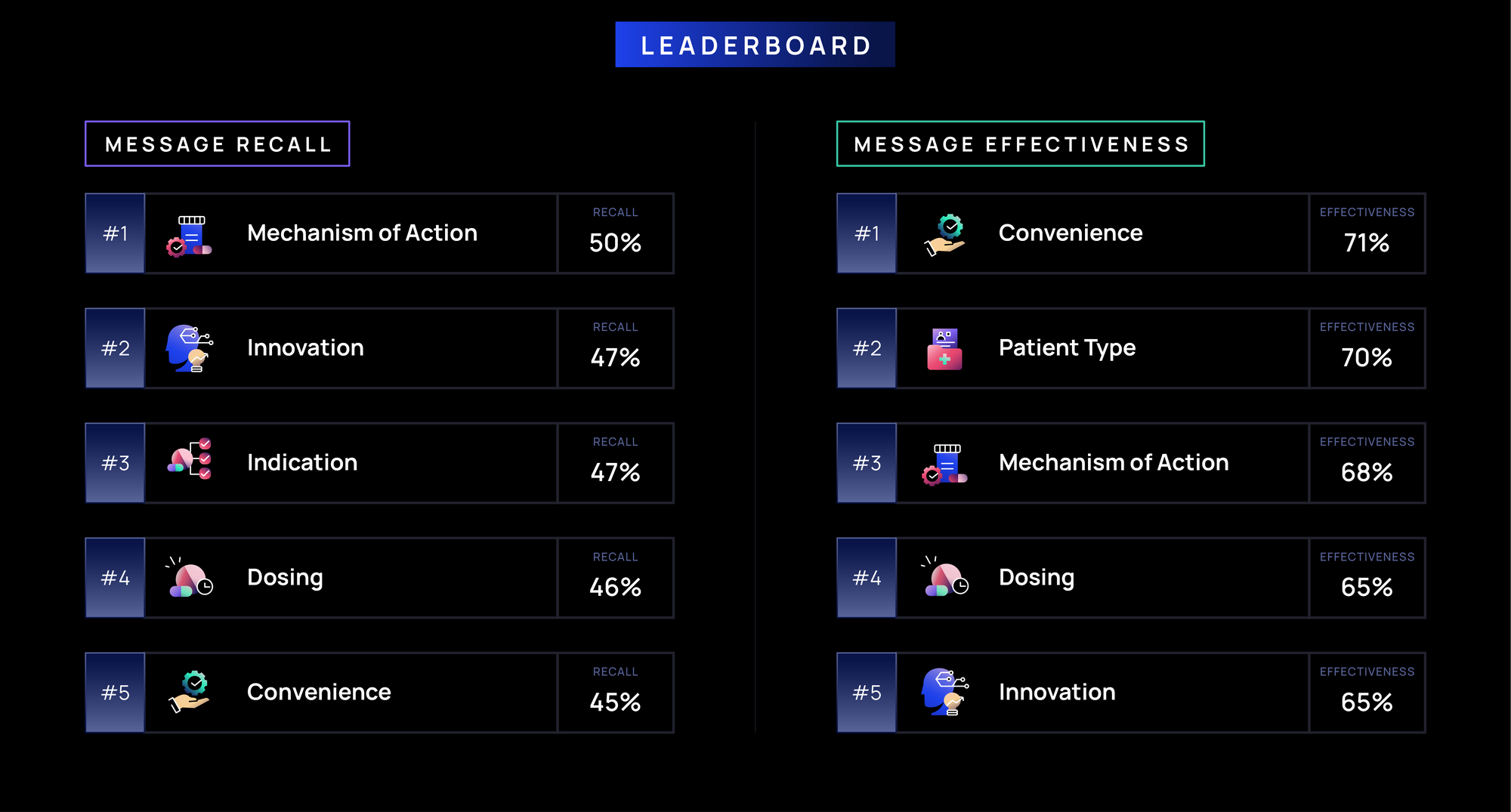

Rare Diseases Benchmarks Sub-Analysis

Recall:

- Messages that establish a brand’s role in treatment (e.g., Indication, Innovation, Mode of Administration, Guidelines) have the highest recall (>40%), as rare disease treaters rely on clear diagnostic and usage criteria given the complexity and heterogeneity of these conditions.

- In contrast, messages on Access, Patient Support, and Insurance (less than 30%) see lower recall, as treatment decisions in rare diseases are often clinically driven, with access being a later-stage consideration.

Effectiveness:

- Messages tied to treatment decision-making and uniqueness (e.g., Innovation, Mechanism of Action, Dosing, Manufacturing) show the highest effectiveness (>60%), reflecting the importance of novel treatment options, administration feasibility, and ensuring product availability in a setting where treatment choices are limited.

- Messages on Access, Side Effects, and Insurance (~50% or lower) are less effective, as rare disease treaters may prioritize clinical benefit over logistical concerns, with access often managed by other stakeholders in the care team.

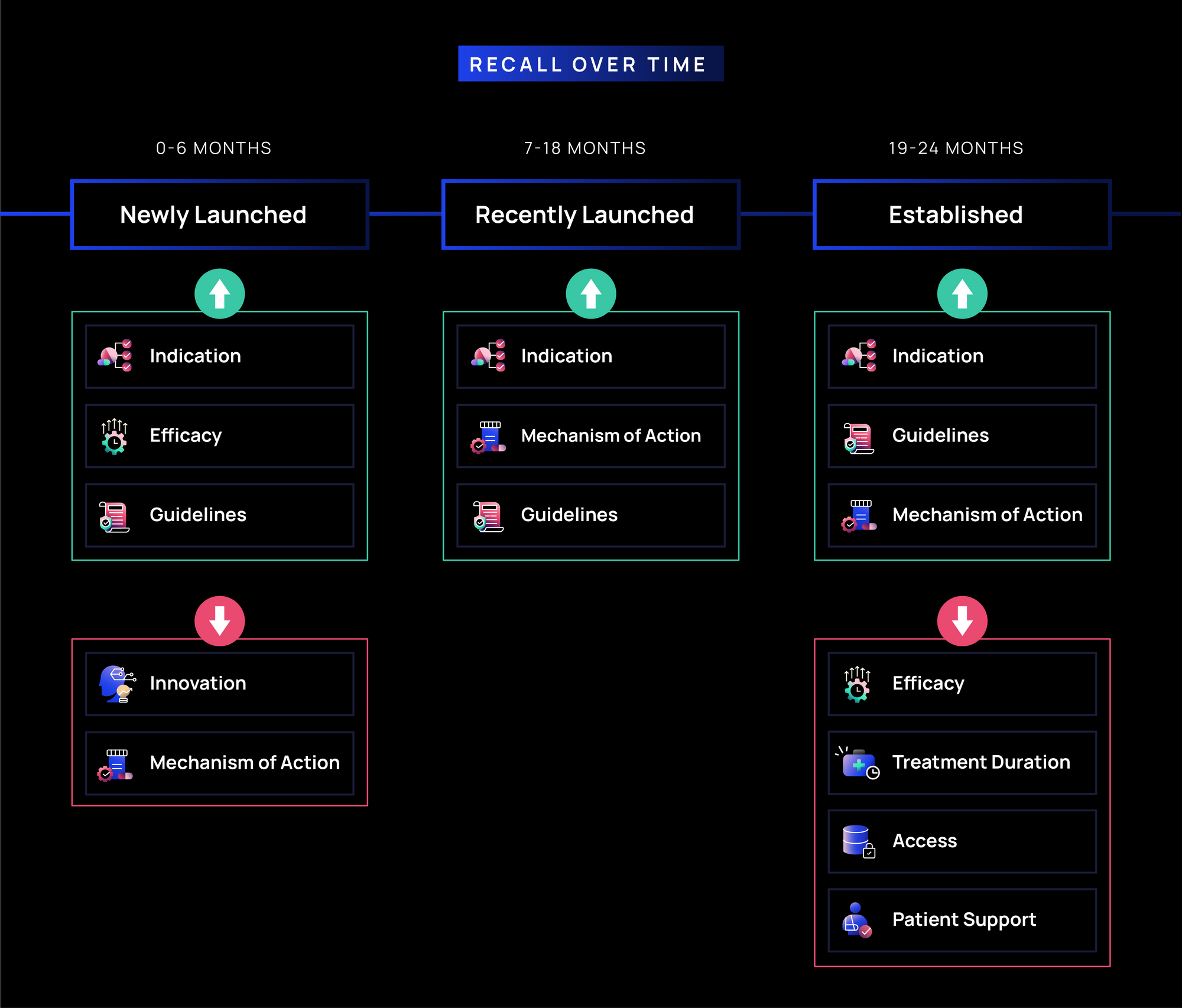

Recall Over Time in Rare Diseases:

- Newly Launched (0-6 months): Indication, Efficacy, and Guidelines have the strongest recall (~37-42%), as rare disease treaters prioritize clarity on when and how to use a treatment. Messages on MOA and Innovation (~35-39%) see moderate recall, as differentiation is likely important but secondary to foundational understanding, given fewer players in rare disease markets.

- Recently Launched (7-18 months): Recall of Indication, MOA, and Guidelines (~35-40%) remains steady, reinforcing the importance of clinical positioning as treaters gain familiarity.

- Established (19-24 months): Indication, Guidelines, and MOA (~34-39%) remain the most recalled, emphasizing their continued role in reinforcing appropriate use. Efficacy and Treatment Duration (~32-35%) recall softens, likely as HCPs become more familiar with the clinical data. Access and Patient Support (~30-32%) remain lower in recall, as rare disease treaters may be less directly involved in managing insurance and logistical support.

Effectiveness Over Time in Rare Diseases:

- Newly Launched (0-6 months): Indication, Efficacy, and MOA (~62-70%) drive early effectiveness, as rare disease treaters need clarity on clinical value and detailed evidence of a new product, especially, in the absence of many alternatives or comparators. Treatment logistics messages (e.g., Dosing and Treatment Duration (~63-64%) also resonate, as rare disease treaters require a deeper understanding of how to incorporate a new therapy into complex, often individualized treatment plans.

- Recently Launched (7-18 months): Effectiveness of Efficacy, MOA, and Indication (~62-65%) remains high, reinforcing confidence in clinical benefit. Guidelines (~73%) gain traction likely offering critical validation in a space where clear treatment protocols are often less defined.

- Established (19-24 months): Indication and Guidelines (~61-73%) continue to drive effectiveness, supporting long-term adoption. MOA and Innovation (~65-70%) remain impactful for differentiation, while Side Effects and Access (~49-52%) become less effective.

Get in touch with ZoomRx to learn how our strategic life sciences consulting services can support your goals.