Executive Summary

In the ever-evolving pharmaceutical industry, the perception of healthcare professionals (HCPs) can make or break a company's success. Understanding what HCPs value and how they perceive different pharma manufacturers is essential for strategic planning and market positioning.

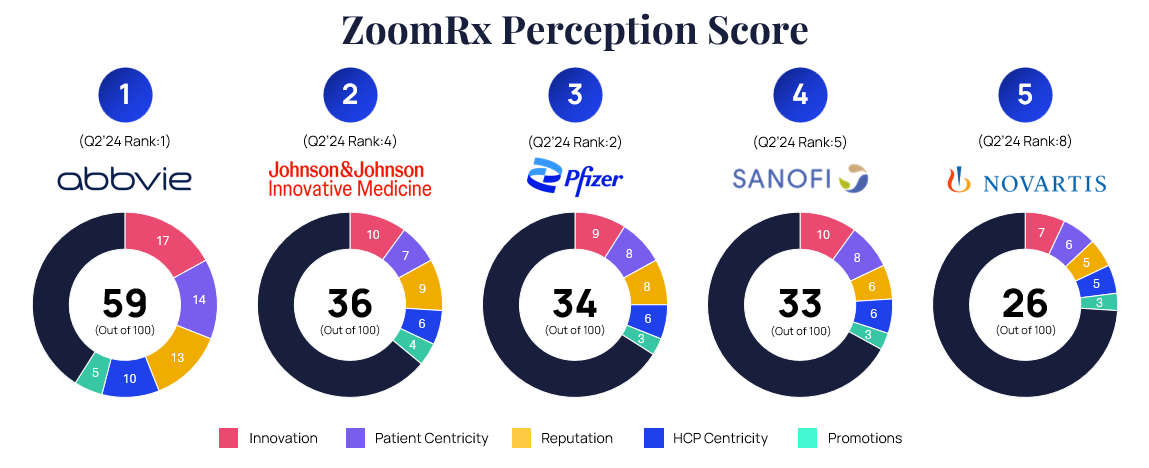

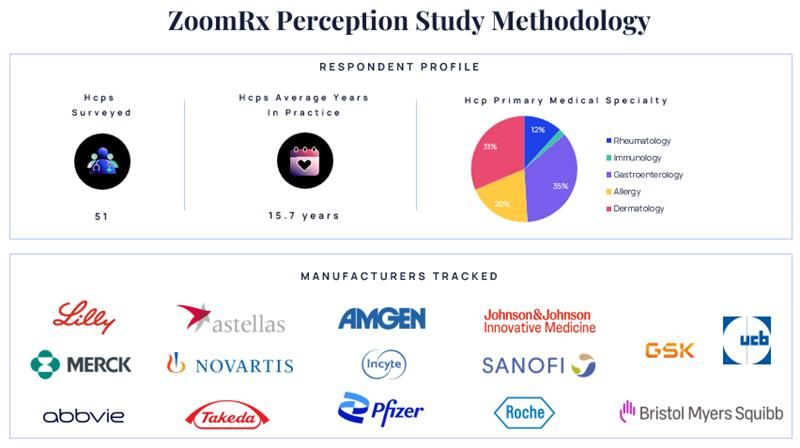

In Q2’2025, we asked of over 50 healthcare providers (HCPs) in the US treating immune conditions to dissect the competitive standings of the top 5 manufacturers among 15 tracked, identifying key perception drivers and strategic imperatives.

Key Findings:

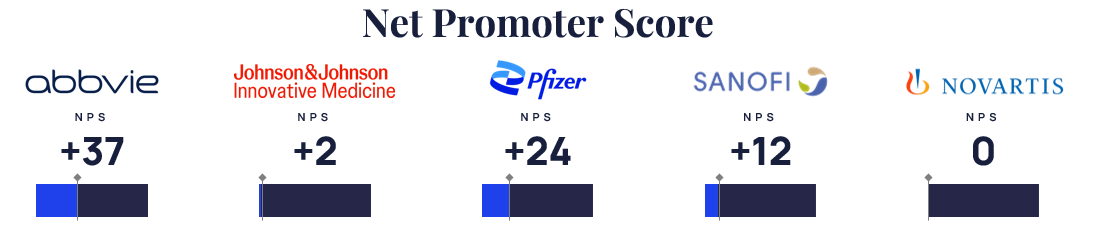

- AbbVie’s Dominance: AbbVie achieved a ZoomRx Perception Score of 59 out of 100 and an NPS of 37, significantly outperforming its competitors.

- Wide Gaps in Perception and Loyalty: While AbbVie leads, other companies within the top 5, like Johnson & Johnson, Pfizer, Sanofi, and Novartis lag behind, showing a significant gap in both perception and loyalty.

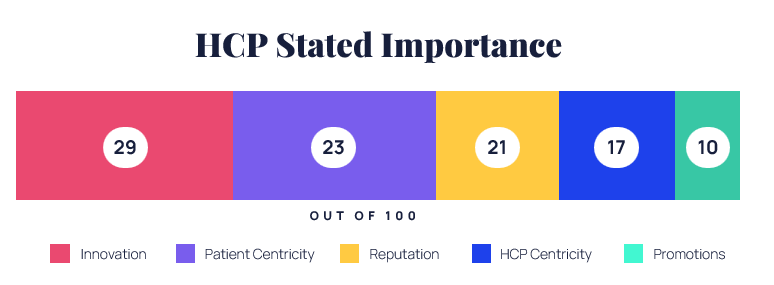

- Innovation is King: HCPs prioritized innovation above all, assigning it the highest importance score, followed by patient-centricity and reputation

AbbVie’s commanding lead sets a high benchmark, challenging competitors to innovate and connect with HCPs effectively.

The Perception Landscape: Top 5 Standings

Among the 15 manufacturers tracked, the top 5 in Q2 2025 form a tiered hierarchy, with AbbVie’s dominantly ahead of the rest

- AbbVie achieves total perception dominance, with a perception score of 59 and an NPS of 37, the highest among all companies, reflecting strong physician loyalty. Its strengths lie in innovation, HCP centricity, and patient centricity.

“AbbVie has a diverse product lineup that includes best-in-class medications (e.g., Skyrizi). They also have a strong pipeline and a robust patient assistance program to ensure affordability of their drugs.”

2. Johnson & Johnson ranks second, showing improvement from Q2 2024 (rank 4 to 2). Its strengths include innovation and HCP centricity, with physicians appreciating its wide product range, especially in rheumatology

“They have a wide variety of products for the field of rheumatology,”

“They provide assistance to nursing staff and physicians with their products”

3. Pfizer ranks third, closely following J&J, recognized for its leadership in gastroenterology and hepatology, and effective patient support programs

“Pfizer is a leader since it has quite a few products in the gastroenterology arm. Also in hepatology, they are leaders in the inflammatory bowel’s component of GI”

4. Sanofi scores 33, almost on par with Pfizer, noted for its innovation, especially Dupixent in the immunology

“They were one of the leaders that developed IL13/IL4 inhibitors which paved the way for a new generation of immunological treatments”

5. Novartis shows the strongest momentum, climbing from rank 8 (in Q2’2024) to 5. While HCPs appreciate its patient access initiatives, it still trials behind indicating room for improvement

“The first company to come with the so-called bridge program, essentially allowing access to all patients, no matter what their economic, social insurance status”

What Matters Most to HCPs?

When asked to rate the importance of various factors, HCPs overwhelmingly prioritized innovation, followed by Patient Centricity, and Reputation. This emphasis on innovation suggests that HCPs are looking for pharmaceutical companies that are at the forefront of medical advancements, developing new treatments that can make a real difference in patient care.

But innovation alone doesn’t drive loyalty.

AbbVie stands out with an impressive Net Promoter Score (NPS) of 37— well ahead of Pfizer, Sanofi, Johnson & Johnson, and Novartis. In addition to its strong portfolio, which includes Skyrizi and Rinvoq, AbbVie’s decade‑long commitment to engaging patients and HCPs has built the loyalty and trust that set it apart.

Some companies have come and gone but we have been partners with Abbvie on a consistent basis for >10 years. No other company has been "with us" as long, on a consistent basis

-HCP on AbbVie

Pathways to Perception Leadership

The survey insights and financial performance highlight tailored strategies for each company to enhance their position:

- AbbVie: With a strong lead, AbbVie must continue investing in Skyrizi and Rinvoq to sustain growth post-Humira. Their patient assistance programs, praised by HCPs, should be further leveraged to ensure accessibility

- Johnson & Johnson: Expansion of Tremfya’s indications and pipeline drugs like Nipocalimab, positions them for future growth. Continued focus on innovation and payer support will help close the gap with AbbVie

- Pfizer: Pfizer needs to strength its immunology portfolio via acquisitions and new launches. Addressing Xeljanz’s safety concerns and scaling Vabysmo are priorities.[2]

- Sanofi: Dupixent shines, but competition from Lilly’s lebrikizumab and GSK’s depemokimab requires enhanced HCP engagement[3].

- Novartis: Momentum from Cosentyx and Xolair positions it as a disruptor. Phase 3 projects could challenge higher ranks.[4]

Methodology

This whitepaper is based on a survey conducted in April 2025, involving over 50 healthcare providers (HCPs) in the US representing key immunology-related specialties. ZoomRx’s perception score methodology evaluates 15 immunology manufacturers across five weighted dimensions—Innovation, Patient Centricity, Reputation, HCP Centricity, and Promotions—to generate a score out of 100.

For more information, contact: info@zoomrx.com

References:

- Johnson & Johnson. (2025). Q1 2025 Results. Link

- Pfizer. (2025). Full-Year 2025 Guidance. Link

- Sanofi. (2023). Pipeline Transformation to Accelerate Growth. Link

- Novartis. (2025). Pipeline and Strategic Focus. Link

- AbbVie (2024). Full Year Financial Results. Link