What drives Neurologists’ mindshare in a space with multiple alternatives?

Executive Summary

The neurology therapeutic landscape is one of the most intensely competitive, creating a significant challenge for pharmaceutical marketers fighting for neurologists’ attention.

Our latest analysis of top-of-mind awareness (TOMA) among 50+ neurologists reveals a market defined by a striking paradox. While individual brands are lost in a sea of fragmentation, neurologists impose their own order by thinking in clear, consolidated categories of drug class and indication.

"In neurology, where the noise is constant, the only voice that resonates is the one grounded in solid clinical evidence."

Key Findings

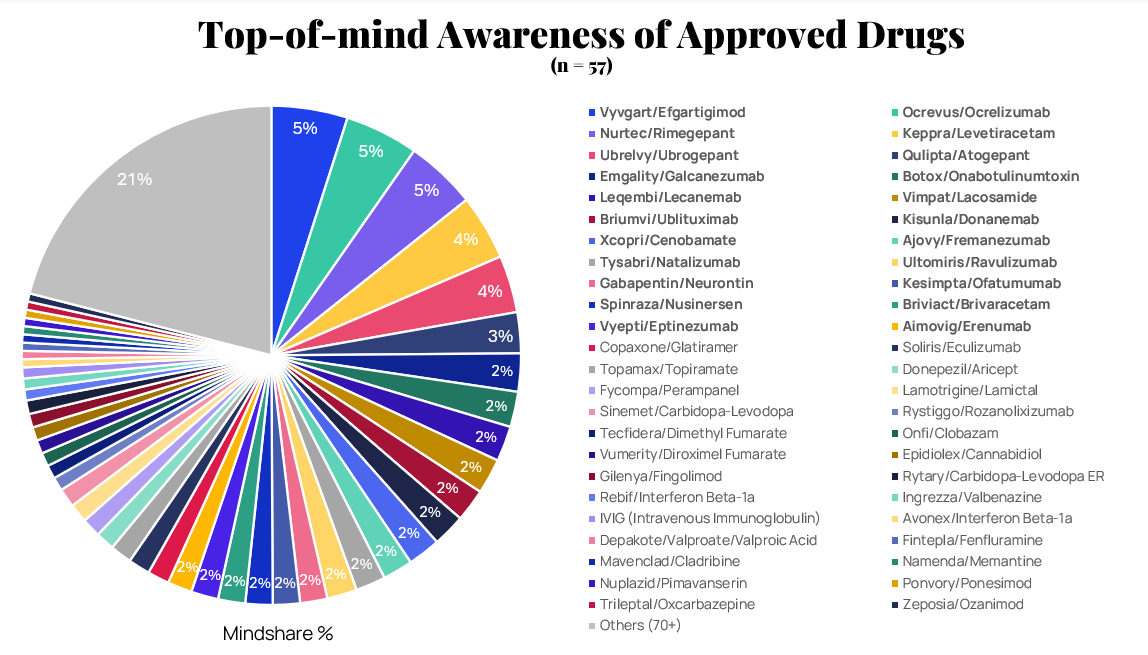

- A Diverse Brand Landscape: No single brand commands more than 5% of neurologist mindshare. The market is profoundly fragmented across more than 120 different drugs.

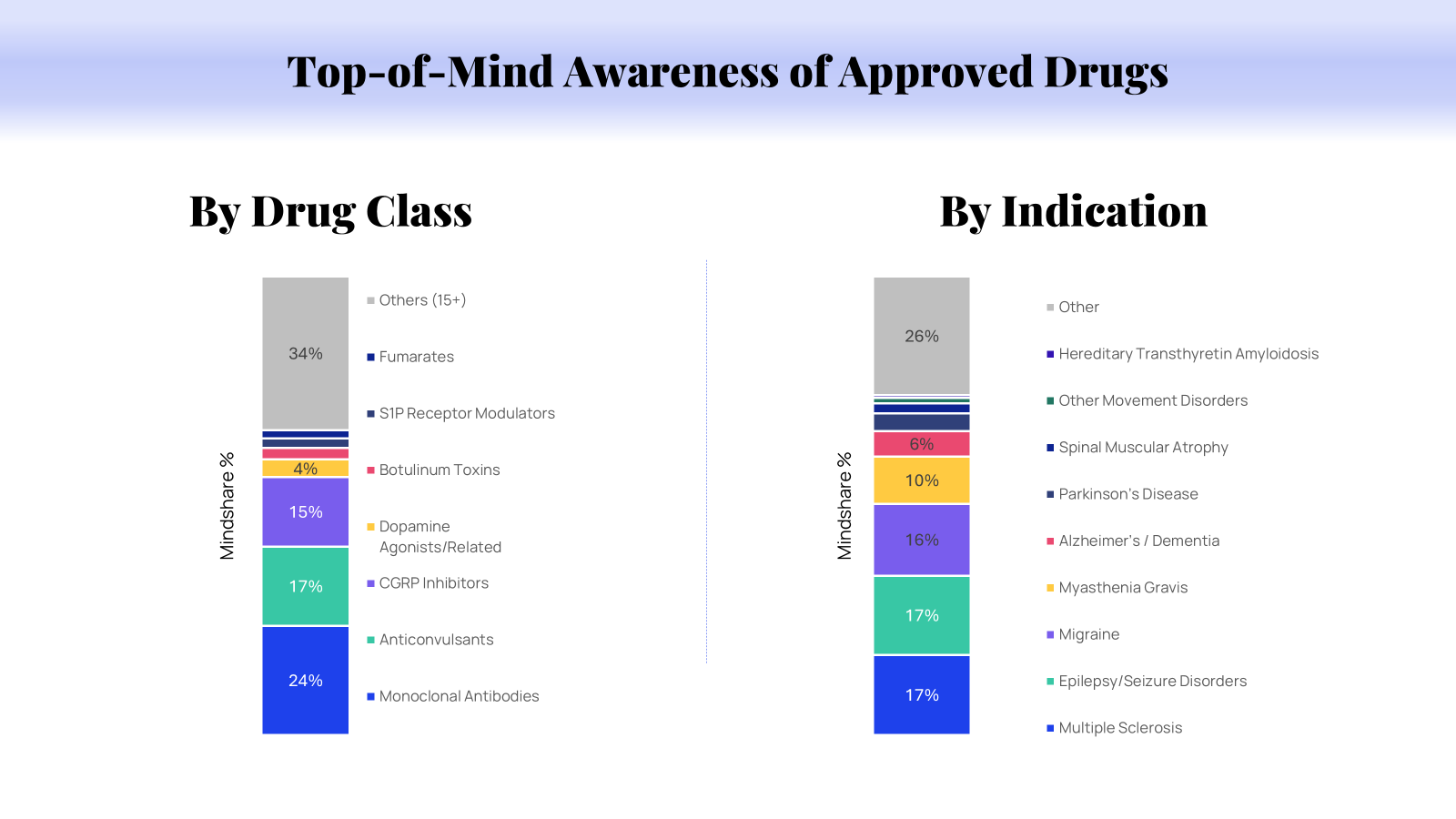

- Neurologists Think in Categories: While brands are a blur, neurologists have a sharp focus on categories. Mindshare coalesces powerfully around Drug Class, with Monoclonal Antibodies (24%) leading the pack, and around Indication, where MS, Epilepsy, and Migraine form a dominant triad.

- Two Blueprints for Leadership: Manufacturers achieve prominence through either broad portfolio strength (Biogen) or single-asset innovation, where one blockbuster like Argenx's Vyvgart can stand alongside an entire roster.

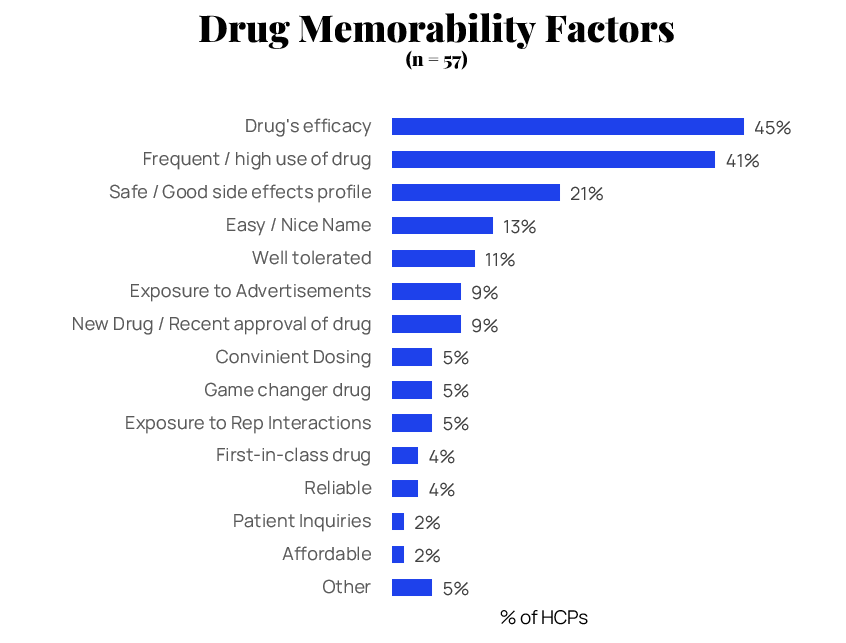

- Clinical Proof is Paramount: Clinical value is the ultimate driver of memorability. Efficacy and safety are the definitive factors that earn a drug a place in a neurologist's mind.

Navigating a Fragmented Brand Landscape

A modern neurologist navigates a rich and expanding portfolio of treatments. Our data shows that top-of-mind awareness for approved drugs is not a pyramid with a single leader, but a remarkably balanced ecosystem. With no single brand capturing more than 5% of unaided recall, the landscape clearly reflects just how broad and competitive the options are.

But neurologists have their own mental filing system. Beneath the brand-level confusion lies a highly structured framework built on clinical utility.

When we analyze mindshare by drug class, a clear hierarchy emerges. Monoclonal Antibodies are the most dominant category, followed by Anticonvulsants and CGRP Inhibitors. This reveals that a drug’s mechanism is its primary identity.

Similarly, top-of-mind awareness by indication is highly concentrated. Multiple Sclerosis, Epilepsy/Seizure Disorders, and Migraine are the undisputed "big three," each commanding an identical slice of physician attention and dwarfing other major conditions.

The Companies That Cut Through the Noise

This categorical thinking defines the two winning strategies for manufacturers.

The first is Portfolio Power. Biogen and Novartis leverage their deep rosters of established drugs in core indications—particularly Multiple Sclerosis—to create a wide footprint that ensures high recall. They win through breadth and by being synonymous with a high-value indication.

The second path is the Single-Asset Superstar. Argenx has crashed the party with a lone blockbuster, Vyvgart. By delivering a revolutionary therapy, Argenx has achieved a level of manufacturer mindshare comparable to the portfolio giants, proving that a single, game-changing drug can create its own gravitational pull. UCB (with Keppra and Vimpat) and Roche/Genentech (with Ocrevus) also demonstrate the power of owning a category with key assets.

The Ultimate Currency: Undeniable Clinical Performance

Whether a company has one drug or ten, the underlying driver of memorability is the same: performance.

When we asked neurologists what makes a drug stick in their mind, their answers were overwhelmingly clinical. Efficacy (45%) and Safety (21%) are paramount. As one physician noted, a drug is memorable because it "can potentially reverse the course of disease." Another praised a different therapy for its "lack of scary side effects, lack of interactions."

This sends a clear message: marketing budgets cannot buy mindshare if the clinical story isn't compelling. The path to recall runs through the clinical evidence, not the ad buy.

Strategic Implications for Pharmaceutical Marketers

- Lead with the Science

Efficacy and safety data are your primary marketing tools. Your commercial strategy must be built on a foundation of undeniable clinical value that directly addresses the priorities of neurologists. - Own the Category Conversation

Your primary goal should be to become synonymous with best-in-class performance within your drug’s mechanism and indication. Frame your messaging to establish your product as the definitive MAb for MS or the safest Anticonvulsant for complex patients. - Amplify Your Physician Advocates

The most credible voice in marketing is a trusted peer. Engage clinical experts and early adopters who’ve seen your drug’s performance up close to build genuine advocacy that goes beyond any brand message.

Conclusion

The neurology market operates on a clear paradox: while individual brand recall is weak, physician thinking is highly structured around drug class, indication, and the manufacturers who lead them. Success is not about having the loudest voice, but the most compelling clinical data. The winning companies are those who either build a dominant portfolio within a key category or launch a single, revolutionary product that cannot be ignored. In the neurologist’s mind, performance is the only metric that matters.

Methodology: The findings in this report are based on a survey of 57 US Neurologists conducted in July, 2025. The survey utilized open-ended questions to capture unaided, top-of-mind recall for both approved and pipeline neurology drugs and the factors driving that awareness.

For more information, contact: varsha.sundaram@zoomrx.com

Get in touch with us: