Executive Summary

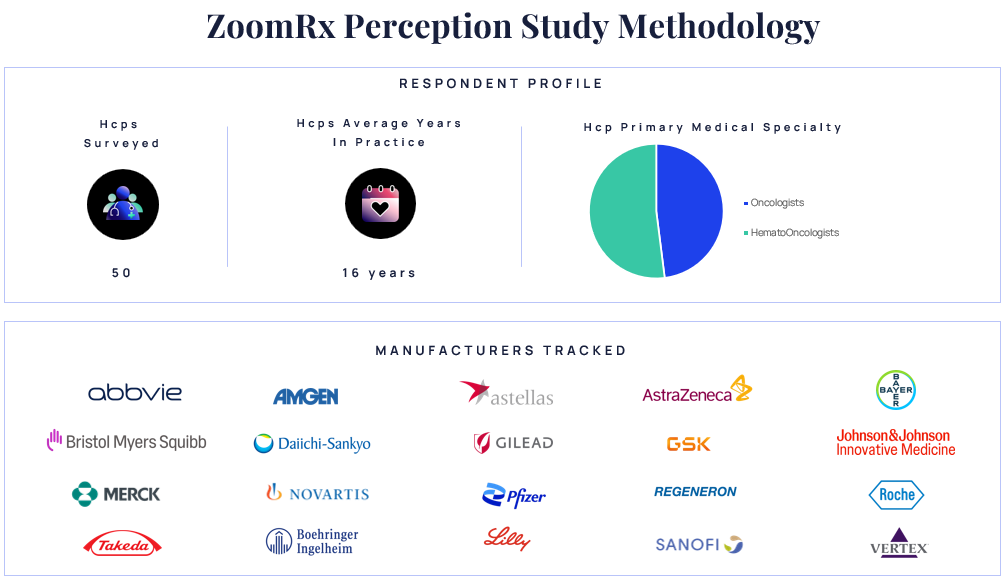

The oncology pharmaceutical landscape in 2025 is fiercely competitive, with healthcare professionals (HCPs) placing a premium on innovation and patient-centricity. ZoomRx surveyed 50 US-based oncologists and hem-oncologists to evaluate perceptions of 20 manufacturers, focusing on the top five. This whitepaper uncovers key drivers of HCP perception and loyalty, and outlines strategic pathways for leadership in this critical field, contextualizing rankings and future strategies.

Key Findings:

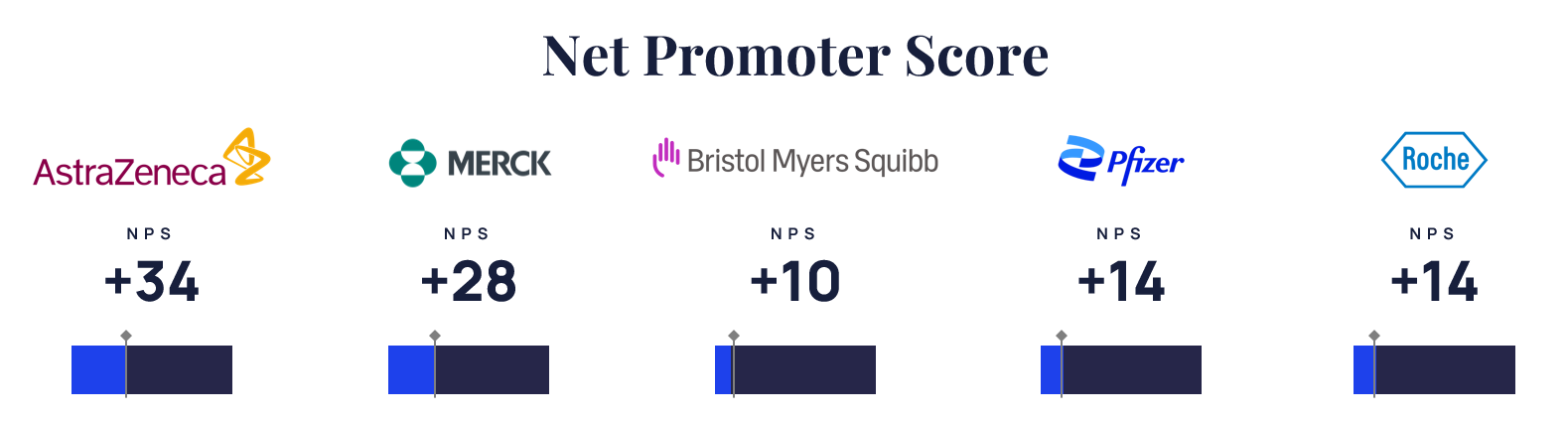

- AstraZeneca’s Lead, Merck closely follows: AstraZeneca tops the rankings with a ZoomRx Perception Score of 43 and an NPS of 34, driven by its innovative portfolio and strong HCP engagement.

- Wide Gaps in Perception and Loyalty: Merck, Bristol Myers Squibb (BMS), Pfizer, and Roche round out the top five, but gaps in perception and loyalty are evident.

- Innovation Tops Priorities: HCPs value innovation most, followed by patient-centricity and reputation—signalling a demand for cutting-edge therapies and robust patient support.

- Loyalty Challenges: AstraZeneca’s lead underscores the need for competitors to strengthen innovation and HCP relationships.

Innovation isn’t enough—HCPs seek partners who engage deeply and deliver accessible solutions.

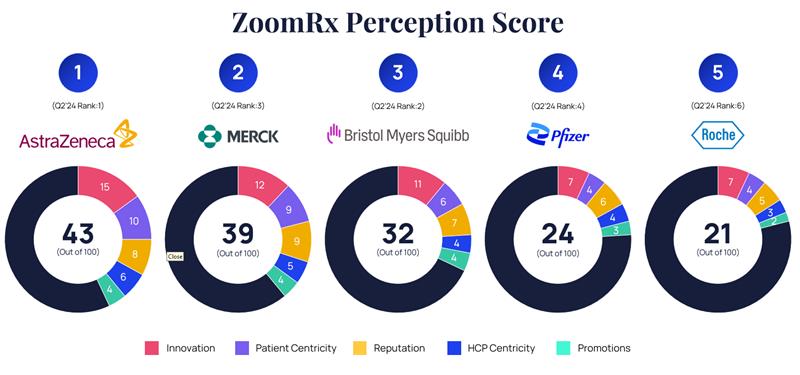

The Perception Landscape: Top 5 Standings

The top 5 manufacturers in Q2 2025 reveal a clear hierarchy, with AstraZeneca setting the pace.

- AstraZeneca leads the perception landscape, dominating in innovation, particularly in targeted therapies and ADCs. The company ranks highest in both perception and NPS.

"I choose AstraZeneca for Oncology field because they have broad products and they are also a leader in innovation including the targeted therapy, ADC, etc.” - Merck closely follows propelled by Keytruda's dominance. Merck leads in reputation and commercial execution but shows room for improvement in patient centricity.

“They have a big pipeline, they’re easy to work with. But honestly, to me, I kind of think all companies are similar in some degree.” - BMS maintains its position through leadership in immunotherapy and robust patient support programs. Its innovation is recognized, keeping it among the top tier.

“BMS, they have the patient support program, assistant program, and we have used and feel it’s very much helpful for patients.” - Pfizer ranks fourth, with balanced reputation metrics but lower scores in innovation and patient centricity—indicating unmet needs in engagement strategy.

“Quality of oncology pipeline and good physician communication.” - Roche has a legacy of innovation with biologics like Herceptin and Avastin, but faces challenges in perception across all measured dimensions.

“I would say it’s their presence, you know, past, present and future… rituximab, bevacizumab. But they are continuing to innovate big in the bispecific space, Immunotherapy.”

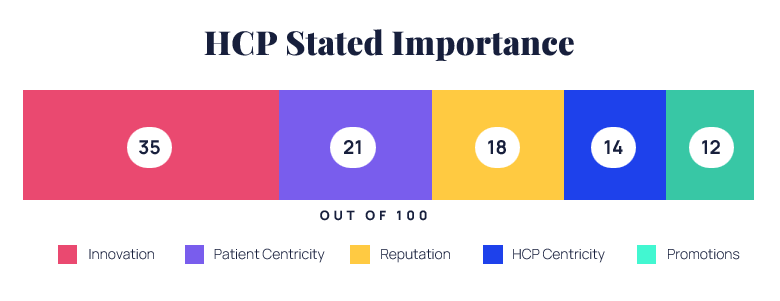

What Matters Most to HCPs?

HCPs prioritize Innovation, followed by Patient-Centricity, Reputation, HCP-Centricity, and Promotions. These findings highlight the need for groundbreaking therapies and meaningful patient support

AstraZeneca’s high NPS of 34 reflects its alignment with these priorities, while BMS’s lower NPS of 10 suggests a disconnect despite strong patient programs. Innovation isn’t enough—HCPs seek partners who engage deeply and deliver accessible solutions.

Pathways to Perception Leadership

The survey, supported by secondary research, highlights tailored strategies for the top 5 to strengthen their positions

- AstraZeneca: Continue leading in innovation by expanding targeted therapies and ADCs, leveraging growth from Imfinzi and Tagrisso as highlighted in 2024 earnings[1].

- Merck: Build on Keytruda’s success by accelerating pipeline development to counter looming patent expirations by 2028. Independent R&D investment is essential to maintain differentiation[2].

- BMS: Enhance HCP engagement through digital tools, capitalizing on Opdivo’s strong Q1 2025 performance. However, cost-cutting plans and ongoing layoffs may hinder innovation—BMS must balance this with R&D investment to sustain growth[3].

- Pfizer: Despite acquiring Seagen, pursue further strategic acquisitions to diversify the oncology portfolio. The revenue decline noted in 2024 earnings suggests Seagen’s impact is delayed, raising concerns about short-term growth. Targeting smaller firms could address HCP concerns around innovation and engagement.

- Roche: Accelerate innovation in bispecifics and immunotherapy, building on successes like Perjeta and Tecentriq. Roche must mitigate biosimilar erosion risks by diversifying its oncology portfolio to ensure long-term growth.

Methodology

In April 2025, ZoomRx surveyed 50 US-based oncologists and hemato-oncologists, evaluating 19 manufacturers across five weighted dimensions: Innovation, Patient Centricity, Reputation, HCP Centricity, and Promotions. HCPs ranked the top three manufacturers in each dimension. Scores were weighted by stated importance and scaled to 100.

For more information, contact: varsha.sundaram@zoomrx.com

Get in touch with us