What drives Psychiatrists’ Awareness and Excitement in a space with multiple alternatives?

Executive Summary

The psychiatric drug market is fiercely competitive, with healthcare professionals (HCPs) navigating a crowded landscape of approved and pipeline drugs. We asked 50+ HCPs to understand their top-of-mind awareness, excitement and the key drivers for them both for psychiatric medications.

HCPs value efficacious and safe options among approved products, while novel mechanisms of action drive greater anticipation for pipeline drugs such as Psilocybin, IV Ketamine, and NRX-101.

Key Findings

- Market fragmentation is substantial, with the top 10 approved psychiatric drugs holding almost half of HCP mindshare

- Efficacy benefits and safety profiles are the dominant memorability factors for approved psychiatric medications

- Novel mechanism of action is the primary driver of excitement for pipeline drugs among HCPs

- Three innovative pipeline drugs command significant mindshare despite not yet receiving regulatory approval

- Older medications maintain dominant position with most top-of-mind awareness going to drugs approved over a decade ago

The Mindshare Landscape: Approved Psychiatric Drugs

Top-of-Mind Awareness: A Fragmented Market

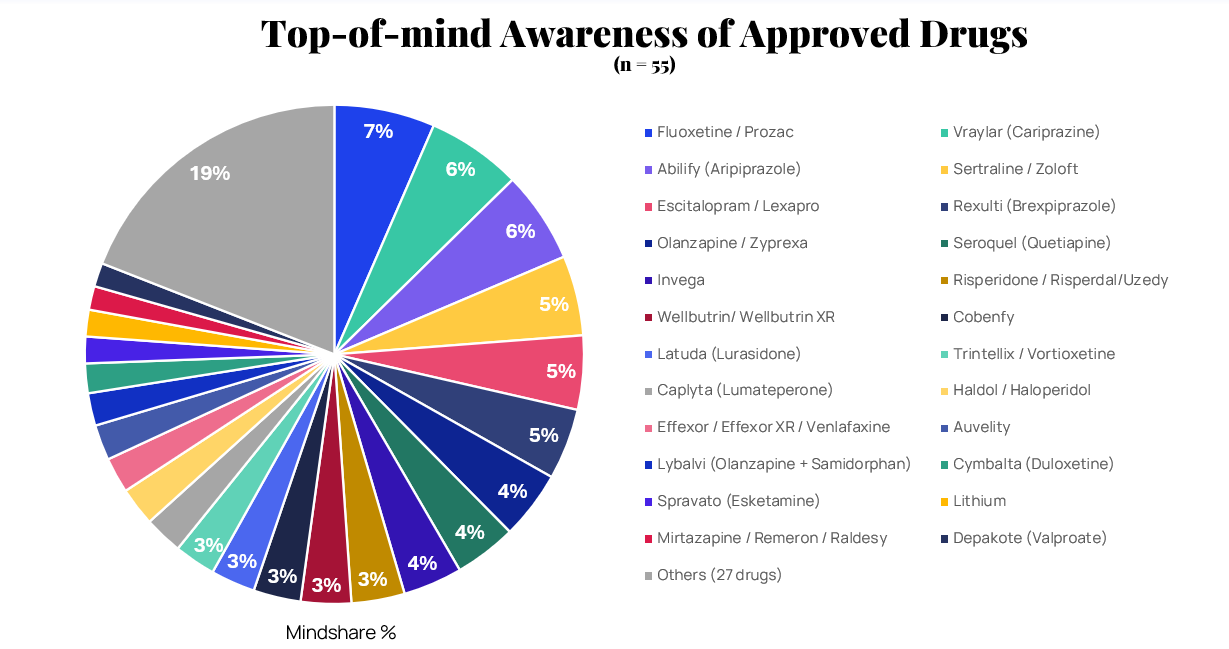

The data shows that the psychiatric drug market is highly fragmented, with the top 10 approved psychiatric drugs holding just 50% of HCP mindshare, with 27 other drugs splitting the remaining awareness. Fluoxetine/Prozac leads at 7%, followed by Vraylar (Cariprazine) and Abilify (Aripiprazole) at 6% each.

This fragmentation signals a lack of dominant players, creating opportunities for targeted marketing strategies. No single medication has achieved overwhelming mindshare, suggesting that HCPs maintain diversified prescribing habits across the psychiatric medication landscape. In terms of manufacturer influence, three companies—Eli Lilly, Johnson & Johnson, and Pfizer—lead in awareness, reflecting their strong portfolios with drugs like Prozac, Invega, and Zoloft.

"Commonly used medication without too many adverse side effects. It's affordable and relatively well known to the public."

— HCP on Fluoxetine/Prozac

What Drives Recall? Efficacy and Safety Lead the Way

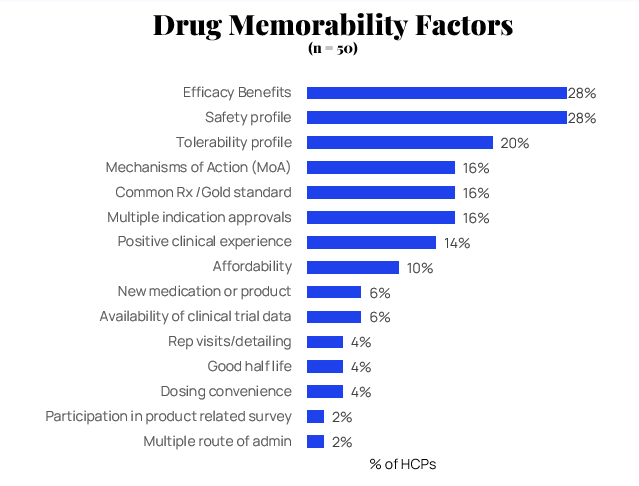

When asked about drug memorability, efficacy benefits and safety profiles are the top factors influencing which psychiatric medications remain top-of-mind. Tolerability profile follows as the third most important factor.

"It has excellent efficacy and almost no side effects. And I think they have an excellent sales force that markets Vraylar. And I've seen excellent results in all of my patients taking Vraylar. I think that I will continue to use more Vraylar in the future. Also, Vraylar has gotten some new indications."

— HCP on Vraylar's memorability

The emphasis on efficacy and safety reflects HCPs' clinical priorities, suggesting that marketing messages focused on these attributes resonate most effectively. Interestingly, mechanisms of action rank lower for approved drugs, indicating that once a medication is established, its clinical performance outweighs its pharmacological innovation in driving continued awareness.

Breakdown by Drug Class, Indication, and Approval Time

Our analysis reveals clear patterns in the types of psychiatric medications that maintain the strongest mindshare among HCPs. Antipsychotics and antidepressants dominate class awareness, while medications for depression and schizophrenia lead indication awareness.

Perhaps most striking is the dominance of legacy medications—the vast majority of top-of-mind drugs have been approved for over 10 years. This finding highlights the considerable challenge facing newer entrants in displacing established treatments from HCP consciousness.

"For the most part, it is weight neutral. It has a better side effect profile than the other antipsychotics and also has good efficacy for Mood Disorders, whether it is Unipolar Depression or Mania."

— HCP on factors that make drugs memorable

Pipeline Drugs: Novelty Sparks Excitement

Pipeline Awareness: A Crowded Field

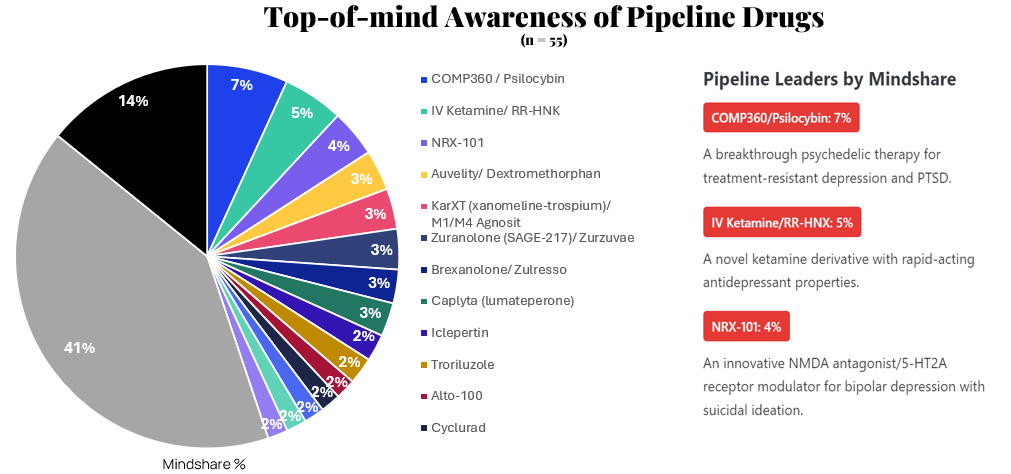

Pipeline drugs show even greater fragmentation than approved medications, with a significant portion of HCPs unaware of any specific candidates. Among those with awareness, three innovative treatments lead: COMP360/Psilocybin, IV Ketamine/RR-HNX, and NRX-101.

The strong mindshare of these pipeline drugs is particularly noteworthy given their pre-approval status, indicating significant interest in their novel approaches to treating psychiatric conditions with substantial unmet needs.

"I'm particularly encouraged about the potential FDA approval for Psilocybin because with guided therapy treatment for the treatment of PTSD and trauma and also treatment-resistant depression and people who suffer from treatment-resistant anxiety as well, is potentially a huge breakthrough in the psychiatric field of medicine."

— HCP on COMP360/Psilocybin

What Fuels Excitement? Novel Mechanisms Take Center Stage

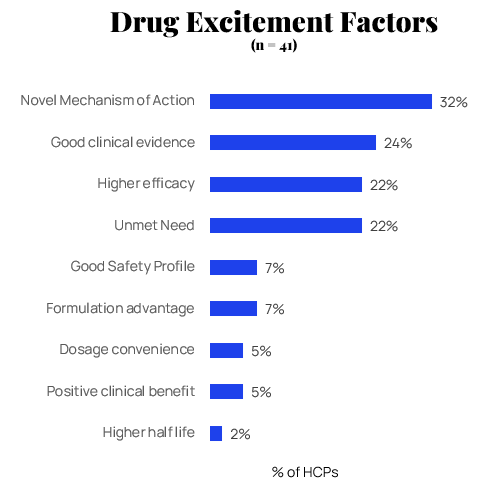

Our research reveals a dramatic shift in what drives HCP interest for pipeline drugs compared to approved medications. A novel mechanism of action is the clear leader as the primary factor fueling excitement about pipeline candidates.

Good clinical evidence and higher efficacy follow as second and third most important factors. This hierarchy highlights a key insight for pharmaceutical marketers: while established drugs are judged primarily on demonstrated clinical performance, pipeline drugs generate interest through the promise of innovative approaches to treatment.

Strategic Implications for Pharmaceutical Marketers

- Efficacy and Safety Are Non-Negotiable: For approved drugs, marketing should focus on clinical data and real-world outcomes. Materials that clearly communicate both efficacy and safety profiles will have the greatest impact on HCP recall.

- Novelty Wins in the Pipeline: Pipeline communications should highlight innovative mechanisms of action supported by preliminary clinical evidence. The interest in psychedelic therapies shows HCPs' openness to revolutionary approaches for treatment-resistant conditions.

- Fragmentation Creates Opportunity: With no dominant player, targeted strategies can boost mindshare for newer entrants through focused messaging that addresses specific clinical needs or patient populations.

- Legacy Drugs Challenge New Entrants: New products must clearly differentiate from established treatments, particularly regarding long-term safety data and diverse indication approvals.

Conclusion

The psychiatric drug market is a battleground of awareness, with different factors driving HCP perceptions at each product stage. For approved drugs, clinical performance dominates, while pipeline candidates generate excitement through innovative mechanisms. This creates a dual imperative for marketers: emphasize efficacy and safety for established drugs while highlighting novel mechanisms for pipeline candidates.

Methodology: This whitepaper is based on survey responses from 55 Healthcare professionals (Psychiatrists) with expertise in psychiatric medications. The research measured top-of-mind awareness, memorability factors, and excitement drivers for both approved and pipeline psychiatric drugs.

For more information, contact: varsha.sundaram@zoomrx.com