BOSTON — August 29, 2022 (Endpoints News)

Oncologists are people too — but just like many people, they’ve become somewhat immune to online advertising.

A new ZoomRx study found that oncologists encountered a median of 54 different pharma brands in banner ads every month. However, when asked about specific brands, oncologists could recall only about nine by name.

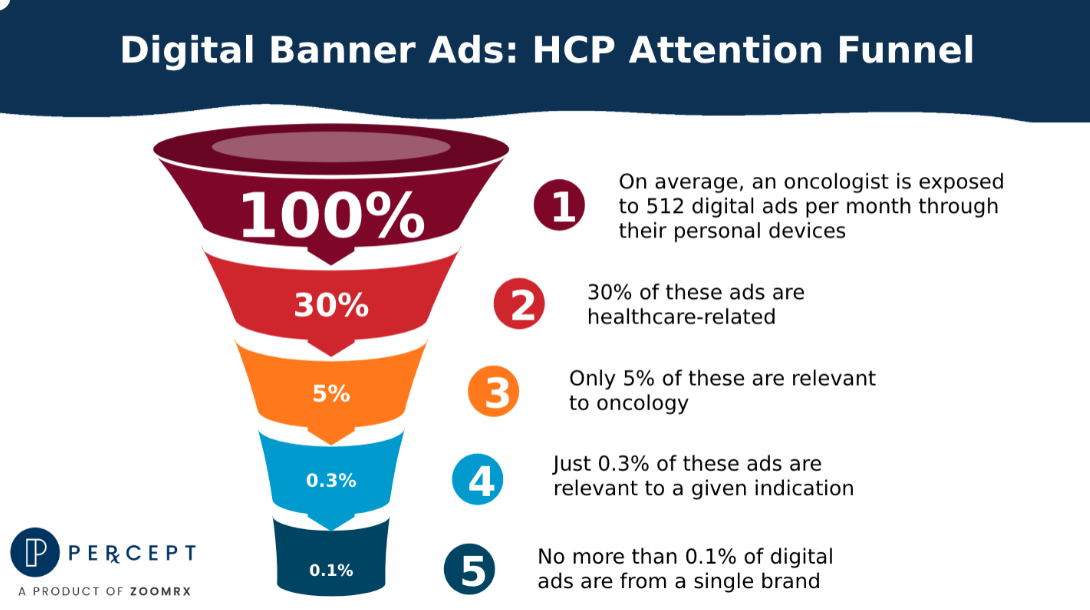

And that’s not the worst of it. Only 5% of all the online banner ads that oncologists encounter monthly are related to oncology. Even more dismal is that no single brand topped 0.3% share of voice, meaning the share of all brands for any one oncologist during the Q2 study period.

That would include big name advertisers such as Merck’s Keytruda, Amgen’s Lumakras and Pfizer’s Xalkori, which ZoomRx identified in a previous July blog post as the top most digitally active oncology brands.

The oncology online ad dive is the first study ZoomRx has done combining two data sources — broad online ad data scraping of the life sciences web along with targeted healthcare provider opted-in tracking — to find out how much promotion they’re exposed to. In this case, the second dataset came from 125 oncologists studied in the second quarter.

“We were not under any illusions that was a small volume of ads, but the total volume and the distributed share of voice — and the fragmented attention from oncologists — we thought was really striking,” said Ty Harkness, ZoomRx associate director of customer engagement.

One of the biggest issues is simply the flood of oncology promotions. A typical oncologist sees 512 banner ads on personal devices every month, the study found.

However, another problem is that the ads are concentrated mostly in just a few places. ZoomRx found more than 125 oncology brands competing on the same top ten most-visited websites including nih.gov, onclive.com, Medscape.com, asco.org and nejm.org.

When asked about the gap between those top 10 and oncology ads on other sites, Harkness said, “It falls off a cliff pretty quickly. From a programmatic perspective, that can get you wider coverage of more websites than just the top 10. But from a direct buy ad perspective, very rarely are brands going outside the top 10 websites.”

Not surprisingly, ZoomRx has developed a custom product PERxCEPT which uses these same two datasets to not only help pharma companies track competitors, but also benchmark their own efforts and find new opportunities in the market. As Harkness said if a competitor is blanketing a website, maybe your brands should be there too — or alternately, using the tracking data to find out where competitors aren’t putting oncology ads.

The initial ZoomRx study focused on oncology, but future therapeutic areas of research and services to pharma clients include primary care and cardiology already started, with an immunotherapy and anti-inflammatory therapy focus coming soon.

Leave your information below to see a 20-minute demo of PERxCEPT and find out how its insights can help you craft your brand's digital strategy.