Launching a pharmaceutical brand is a high stakes endeavor, and ensuring that sales reps deliver the right messages at the right time is critical to success. However, navigating the complexity of pharmaceutical brand messaging – across efficacy, safety, access, and other priority themes requires more than intuition. To cut through this complexity, brands need clear, data-driven insights into which messages drive HCP engagement strategies and ultimately prescribing behavior.

Clarity comes from understanding what works. Tracking message recall and effectiveness provides the visibility needed to refine and optimize brand messaging, however, context is just as important – how does your brand messaging compare to industry norms?

With the industry's largest database of >10 million promotional data points, ZoomRx brings clarity to this question by benchmarking sales rep messaging performance across therapeutic areas, HCP audiences, product lifecycles, and more.

By analyzing >14K messages for >380 brands, we uncovered key patterns in message recall and effectiveness over time. Our findings highlight:

- How message themes (i.e., efficacy, indication, MOA) impact recall and effectiveness overall?

- How message recall and effectiveness evolve across a product’s launch lifecycle: newly launched (0-6 months), recently launched (7-18 months), and established (19-24 months)?

Read on to explore key findings from our messaging benchmark research and how they can inform & sharpen your brand’s messaging strategy.

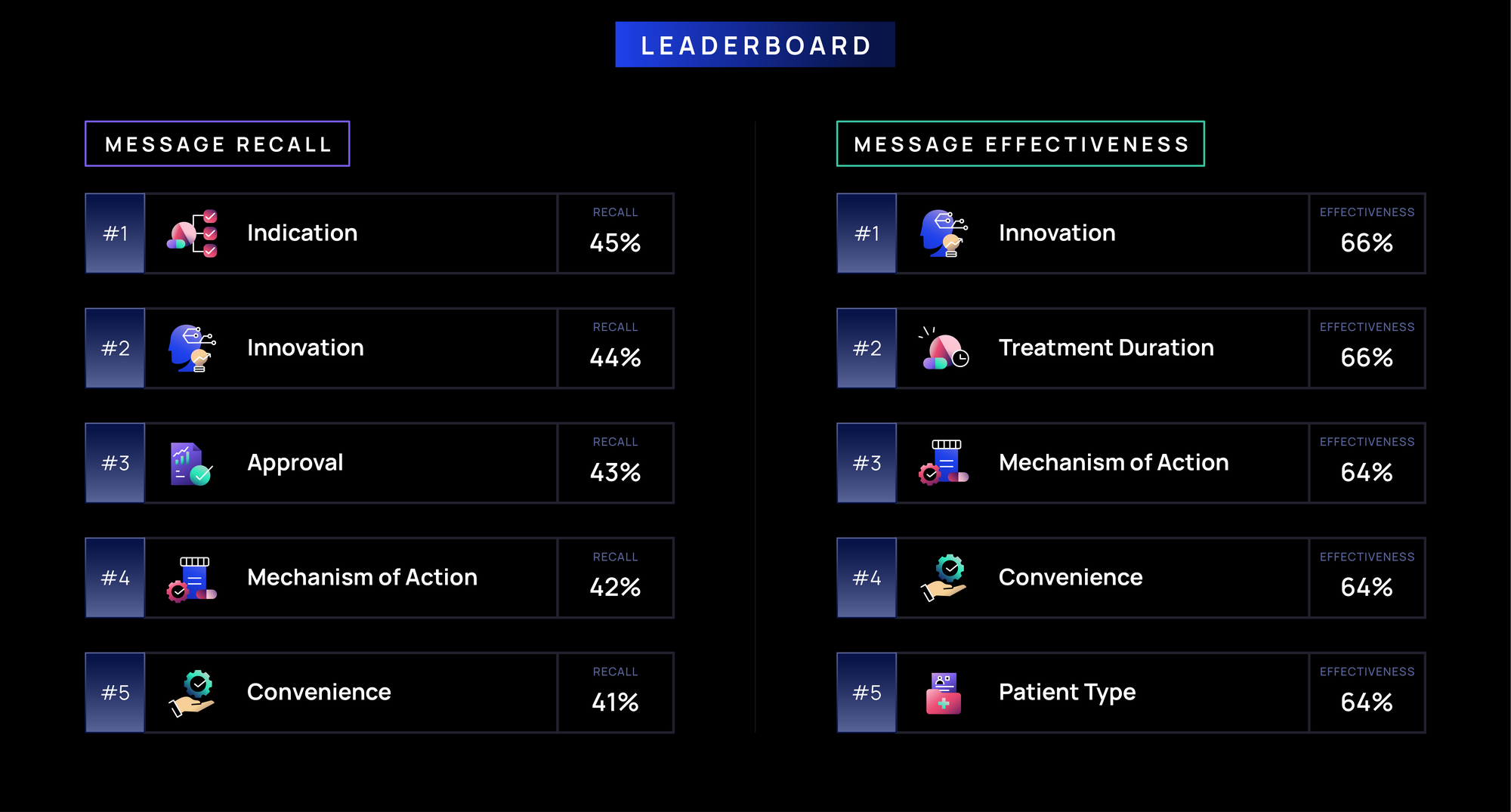

Overall Key Findings by Theme

- Recall: Overall, foundational brand messages (e.g., Indication, Approval, Innovation, Mechanism of Action) that establish a brand’s identity are most recalled (>40%). Meanwhile, messages that speak to brand’s clinical benefits and prescribing logistics (e.g., Efficacy, Safety, Patient Types, Insurance) have moderate recall (30-40%). Messages relating to Testing, Guidelines, Clinical Trial logistics, and Side Effects tend to have lower recall (<30%), likely as they serve to supplement and reinforce the brand’s core foundational and clinical messaging.

- Effectiveness: At an overall level, effectiveness of pharmaceutical messaging tends to be similar (60-65%) across most foundational and clinical messages – possibly due to high overall familiarity with messaging content, ongoing messaging refinement by brands, and consistent delivery. Notably – messages related to Safety, Side Effects, and financial themes (Access, Insurance, Patient Support) tend to be less effective (<60%) – potentially due to lower HCP relevance (as financial messages may be more relevant to office support staff) and emphasis on risks in safety-related messaging.

Recall Over Time

- Newly Launched (0-6 months): Messages that focus on Innovation, Indication, Approval, Mode of Administration, and Convenience drive strongest recall (on average recalled ~50% of the time) for newly-launch brands. These foundational messages help introduce a new brand to the market and this suggests their importance in early HCP engagement.

- Recently Launched (7-18 months): Innovation, Approval, and Convenience message recall softens, with clinical-focused messages (Efficacy, Duration, Dosing) remaining steady with ~35-40% recall. As brands move into the recently launched phase, HCP are likely already primed with foundational messages and more receptive to key clinical messages.

- Established (19-24 months): Over time, recall of several foundational messages continues to decline (Convenience, Mode of Administration, Insurance, Disease State) to <40%, while Indication, Dosing, Approval, Efficacy, Innovation, and Unmet Need emerge as the top recalled (~40-45%). This suggests that as HCPs gain more clinical exposure and experience with the brand, messages related to the brand’s core clinical attributes may be more memorable.

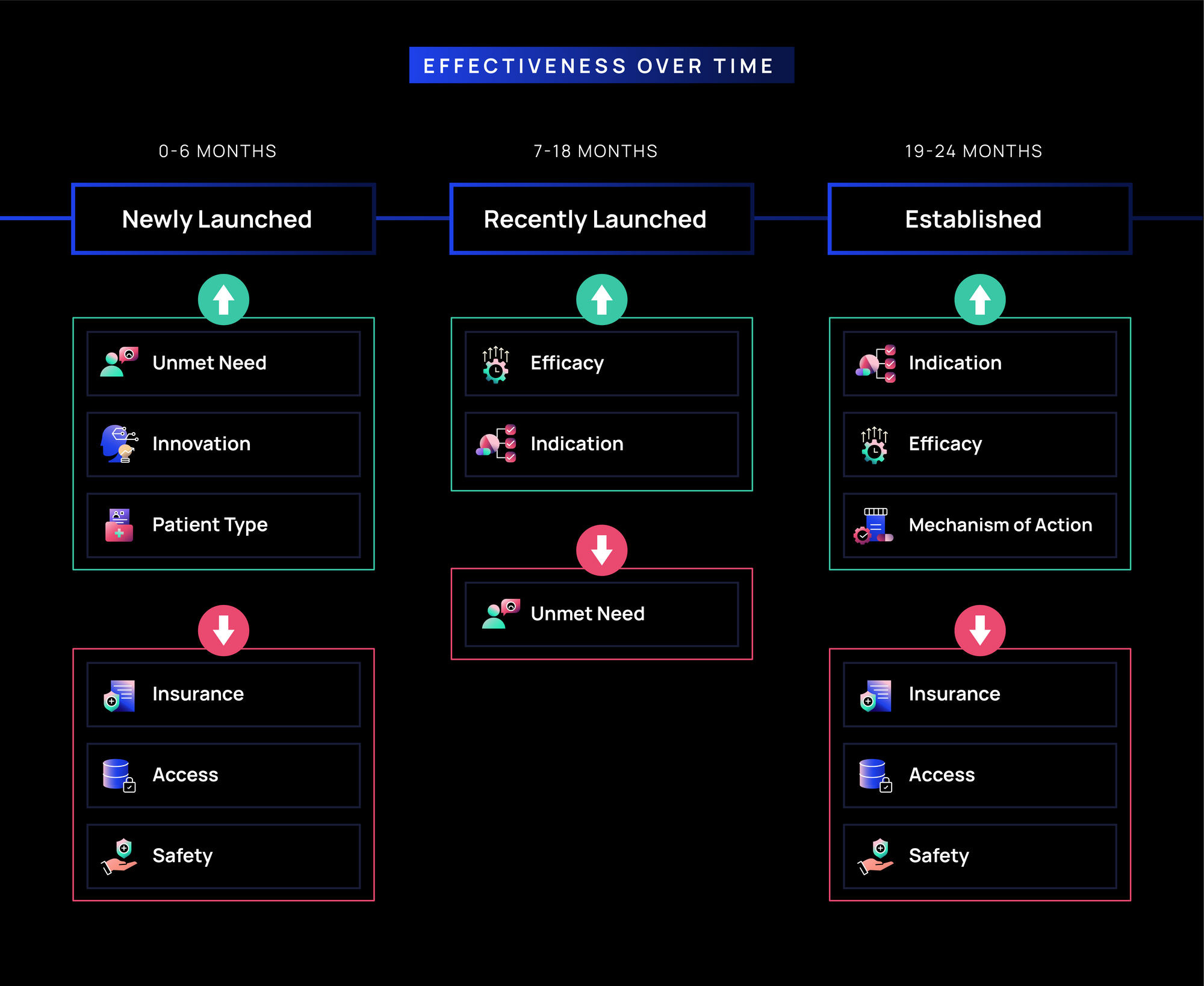

Effectiveness Over Time

- Newly Launched (0-6 months): Unmet Need, Innovation, and Patient Type show the highest effectiveness (~70%), likely driven by a brand’s novelty and highlighting of its potential to close gaps in treatment

- Effectiveness for Insurance, Access, & Safety is lower vs. other themes, indicating these areas might require more tailored messaging (and delivery) to resonate

- Recently Launched (7-18 months): Efficacy and Indication remain consistently effective, while Unmet Need effectiveness drops, potentially due to shifting HCP priorities as they become familiar with the brand

- Established (19-24 months): Indication, Efficacy, Mechanism of Action remain effective even as the brand establishes itself – showcasing their consistent value in pharma messaging benchmarks. Insurance, Access, and Safety maintain lower effectiveness, suggesting these themes are generally less impactful or deprioritized over time.

Takeaways

- Prioritize differentiators in newly launched brand messaging. Prioritize messages that highlight unmet needs, new treatment class or mechanism of action, or innovation in a therapeutic area. These aspects are most likely to resonate with HCPs because they generate excitement and present novel information.

- Balance risk and benefit in safety messaging. When conveying safety information, frame side effects with proper context and alongside the product’s overall benefits. Adding information around patient tools or strategies that can mitigate side effects may also improve the effectiveness of safety messaging.

- Regularly review and adjust messaging based on feedback. Utilize industry benchmarks to understand what resonates with HCPs based on the product lifecycle therapeutic area, HCP type, and more, to set realistic goals. Furthermore, conducting Promotional Effectiveness Tracking and Message Testing helps teams ensure key messages are retained and promotions can quickly adapt in response to HCP feedback, new data, and market dynamics.

Case Studies

Messaging benchmarks provide brand teams with critical insights to inform strategic decision-making and fill gaps where competitor comparisons may be lacking. Below are a few case studies showcasing how brands have leveraged ZoomRx’s benchmarking data to solve key challenges and optimize their messaging:

- Launching a First-in-Market Therapy for Rare Disease Market: A brand was launching the first approved therapy for a rare disease and lacked direct competitors for assessing messaging (and rep) performance. ZoomRx provided benchmarking data from analogous rare disease brands to serve as a proxy for competitive comparison.

- Setting Goals for Launch Campaign: A marketing team developing a campaign for an upcoming brand launch needed guidance on identifying the most impactful messaging themes. By leveraging ZoomRx’s benchmarks, they refined their message sets and identified realistic recall and effectiveness targets.

- Assessing Messaging Shift: A brand team was shifting its messaging to prioritize dosing and safety to ensure treatment adherence; however, competitors did not focus on these themes. Without direct comparisons, the brand team used ZoomRx’s benchmarks to evaluate recall and effectiveness of their dosing messages to optimize their promotions.

These examples illustrate how pharma teams can apply benchmarking insights to bring clarity to their messaging strategy and drive maximum promotional impact.

Conclusion

In today’s competitive market, a strategic, insight-backed approach to pharma brand messaging is essential to driving a brand’s differentiation and commercial success.

Industry benchmarks reveal key trends in message recall and effectiveness, empowering brands to refine promotional strategies across the pharma product lifecycle. Understanding which messages – efficacy, safety, or otherwise – resonate most ensures sales reps focus on what drives impact.

Using ZoomRx’s tailored benchmarks and deep database, brands can have clarity on how to optimize messaging for specific markets, indications, HCP audiences.

Pairing these insights with ongoing message testing and advanced survey tools not only identifies winning messages but also uncovers why they work.

Get in touch with ZoomRx to learn how our strategic life sciences consulting services can support your goals.