The continued growth of personalized medicine and other treatment trends presents new challenges for market researchers.

Within patient populations that were once considered relatively homogenous, new, smaller patient subgroups are being identified as more targeted therapy options become available. In many ways, these subgroups and associated therapies have more in common with rare disease market research than those of more prevalent diseases.

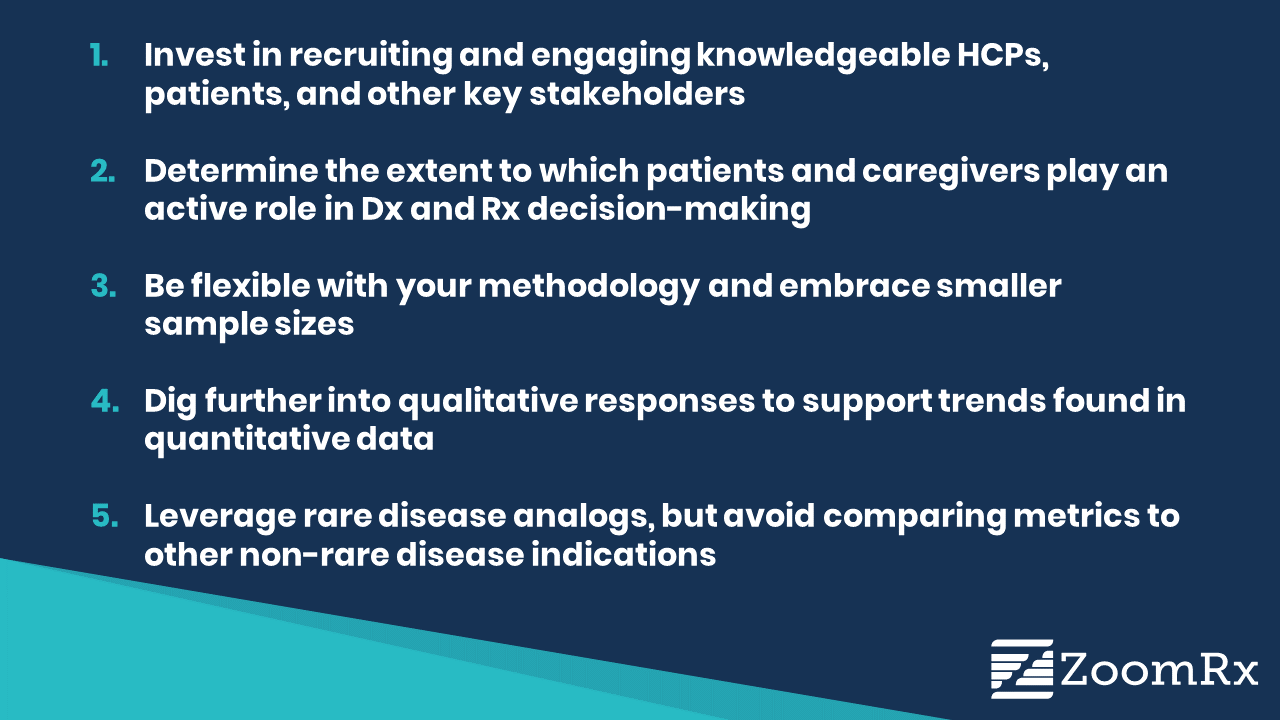

Researchers in the rare disease treatment market have developed a range of strategies for overcoming key challenges and providing valuable insights for strategic decision-making. Below are five of the key lessons we’ve learned through our own rare disease market research that can be applied to small patient subgroups.

1.Invest in recruiting and engaging knowledgeable HCPs, patients, and other key stakeholders

Recruiting for rare disease projects is a more substantial effort, given limited patient populations and the range of stakeholders involved in treatment decisions. These challenges are becoming ever more common when focusing on smaller patient subgroups within more common diseases. To ensure you’re getting the data you need, be sure to:

- Provide ample time for field work - a more hands-on approach to recruitment and respondent engagement will necessitate longer fielding periods

- Cultivate trust with respondents - developing a partnership with respondents through greater transparency with respect to the intentions of the research can encourage useful and consistent participation

- Optimize for inclusiveness - patients, caregivers, care-team coordinators are even more important stakeholders in disease management for rare/orphan indications

Also, read: Gene Therapies Bringing Hope to Rare Disease Management

2. Determine the extent to which patients and caregivers play an active role in Dx and Rx decision-making.

Traditionally, patients, caregivers, and other stakeholders within rare diseases play a large role in treatment decisions. Determining whether this logic applies to relevant sub-populations within your research is key to designing effective studies.

Additionally, understanding how these dynamics may change across treatment settings (COEs, community, etc.) will also prove important. While samples may be small, it is important to have representatives from across different practice types and geographies.

3. Be flexible with your methodology and embrace smaller sample sizes

The effectiveness of the various methodological tools market researchers commonly rely upon, especially quantitative approaches, can be limited when faced with smaller sample sizes. However, where there is a will, there is a way.

Qualitative approaches should be a key part of your toolbox when dealing with smaller patient populations. When go/no-go decisions are at stake, the need to make data-driven decisions necessitates a creative approach. Effective research here is often more accommodating both in the study design and the approach to analysis: longer fielding windows, longer look-back periods, and taking rolling averages across waves are all ways to boost sample for analysis. Measuring performance metrics beyond the promotion of product-use, such as rare disease awareness and identifying undiagnosed patients is another way to provide meaningful insight for brand teams.

4. Dig further into qualitative responses to support trends found in quantitative data

Since sample sizes will often be small, it is important to take an integrative approach that combines multiple data streams to generate insights. By bringing together traditional quantitative and qualitative field research then supplementing with KOL input, feedback from MSL/rep forces, and patient support managers you can more successfully support conclusions that would otherwise be lacking in strength due to sample size.

5. Leverage rare disease analogs, but avoid comparing metrics to other non-rare disease indications

Market researchers will know the value of benchmarking and providing contextualization for the results of one’s findings. However, it is important to adjust your frame of reference when dealing with rare disease treatment market or rare patient subgroups. Comparing your metrics to competitors within more general indications can be misleading and cause you to draw incorrect conclusions. Instead look for analogs within the rare disease space, even those outside of your TA can prove useful for benchmarking given similarities in patient populations and market dynamics.

What's next?

While these five lessons are a great starting point in rare disease market research, every brand targeting small patient sub-populations requires a tailored strategy and tracking approach.

Talk with one of our experts and discuss how to mold an approach fit to your brand’s unique circumstances. We’ll be glad to share more of what we’ve learned and discuss potential solutions to the challenges faced by your team.

Speak with a ZoomRx research expert.